Currently, we have a situation where paddy/rice inflation is largely a problem of distortions in the market introduced by governments, both centre and some states

India’s rice production and government procurement for PDS has been robust

Paddy has been inflating in double digits in wholesale markets since February 2024. Not only is it India’s most important cereal in terms of production, about 69 percent of the central government’s foodgrain allocation under PDS in 2023-24 was rice.

Consistent double digit inflation in paddy, therefore, keeps overall food inflation elevated and makes a majority of RBI’s monetary policy committee disinclined to lower policy interest rate even if headline inflation is projected to trend downwards. Although agriculture accounts for only 18-19 percent of India's gross value added, high inflation often leads to the use of a blunt tool like interest rate adjustments to manage inflation expectations.

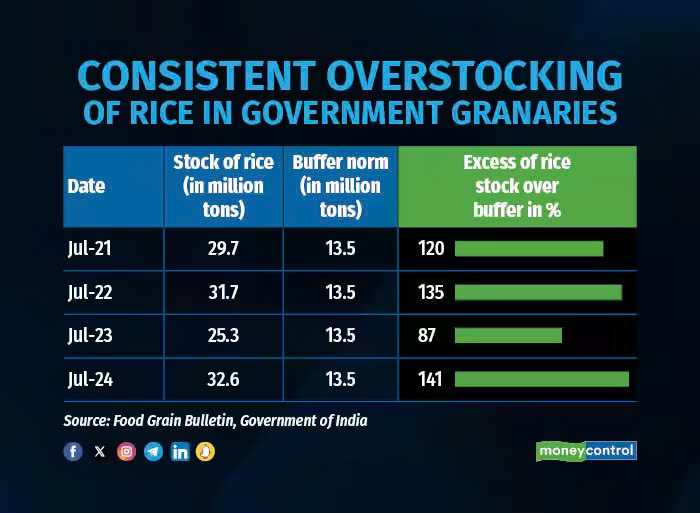

High inflation but abundant supply

India’s rice production and government procurement for PDS has been robust. This is quite different from the trend in wheat, where procurement doesn’t seem to have fully recovered from the extreme weather conditions during the 2022 harvest. Yet, wheat inflation, over the last five months has been in single digits ranging between 2.4 percent and 7.5 percent.

High paddy inflation is an anomaly which can be explained only by the poor management of rice stocks by the government which intervenes heavily in the market to keep its PDS system adequately stocked.

Over the last year, only around 86-90 percent of the monthly rice allocation has been picked up in the PDS. For example, in June 2024, around 90 percent of the rice allocation was picked up, while in the case of wheat, it was 99.5 percent.

Offloading to check inflation hasn’t worked for rice

Given the huge stock at its disposal, the government does try to offload cereals to keep a check on inflation. This effort, however, hasn’t worked for rice while it has been more successful for wheat.

For example, since June 28, 2023, government has used weekly e-auctions to offload wheat and rice. Almost seven months later, till January 24, 71.01 lakh tons of wheat had been offloaded and just 1.62 lakh tons of rice had been sold.

There are structural issues in the sale of rice through auctions which means that once paddy is procured by the government system, anything in excess of what needs to be provided under PDS and other welfare schemes is largely stuck in granaries.

Don’t distort procurement further

Government procurement, or promises of making it more lucrative, is a go-to scheme for political parties trying to please farmers. Two recent election promises which could distort the paddy market further were made by BJP in the Chhattisgarh and Odisha assembly elections. Chhattisgarh, in particular, has emerged as a critical state for paddy procurement. It was next to Punjab in the overall contribution to the government’s paddy procurement exercise in 2023-24.

A top-up on the MSP provides a powerful incentive to farmers to shift away from other crops to paddy. Given that these two states already have a relatively strong procurement system, we run the risk of bigger contributions from these states at a time when the government system is distorting markets by pulling in paddy without having the commensurate mechanism to offload when market prices start rising.

Therefore, it’s important that the central government which bears the cost of procurement, persuades two BJP-administered states to compensate farmers in some other way. Top-ups in this market hurt consumers.

Currently, we have a situation where paddy/rice inflation is largely a problem of distortions in the market introduced by governments, both centre and some states. They need to work at getting out of this situation

Source: moneycontrol