The Philippines, one of the world's largest rice importers, continues to see significant fluctuations in its rice import volumes, driven by rising domestic demand, production challenges, and evolving policy landscapes. Recent data and projections highlight the country's increasing reliance on imports to meet its growing rice consumption needs, but also show a slowdown in import arrivals due to policy uncertainties.

Recent Import Data and Slowdown

According to the Bureau of Plant Industry (BPI), rice import arrivals from January 1 to July 20, 2024, reached 2.39 million metric tons (MMT). However, there has been a notable slowdown in recent weeks:

- Rice imports levied with the new lower 15% tariff rate (implemented after July 6) have only reached 56,073 MT as of July 20.

- This is significantly lower than the average monthly import arrival of about 400,000 MT observed from January to June.

The slowdown is attributed to several factors:

1. Traders and importers are still unloading previously imported stocks.

2. Caution due to pending Supreme Court resolution on a petition against Executive Order (EO) 62, which lowered rice tariffs.

3. Some traders are holding steady on stocks bought at higher prices, hoping for better margins.

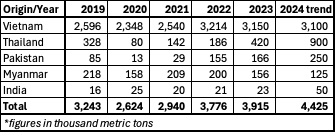

Key Suppliers and Import Volumes (January 1 to July 20, 2024)

1. Vietnam: More than 1.78 MMT (remains the top source)

2. Thailand: 358,727.74 MT

3. Pakistan: 154,523.82 MT (higher than the full-year import volume of 99,280.71 MT in 2023)

4. Myanmar: 66,640 MT

5. India: 21,875.14 MT

Vietnam has traditionally been the Philippines' top rice supplier, but its market share has been declining:

- 2021-2022: 85% market share

- 2023: 80% market share

Leading Importers

Among the 157 rice importers in the Philippines, three companies stand out for their significant import volumes in 2024:

- Orison Free Enterprise Inc. (152,009.35 MT)

- BLY Agri Venture Trading (147,928.99 MT)

- Macman Rice and Corn Trading (115,410.80 MT)

As of July 2024, the BPI had approved and issued 4,995 SPSICs, covering the potential importation of 5.5 MMT of rice.

However, the rice import landscape faces potential changes due to recent policy developments, including Executive Order 62, which is currently under legal scrutiny. This uncertainty may cause importers to adopt a cautious approach, potentially affecting import activities in the short term.

Regulatory Environment and Challenges

The rice import landscape is currently affected by Executive Order 62, which reduced rice tariffs to 15% until 2028. However, this order faces legal challenges:

- Certain groups have filed a case against EO 62 in the Supreme Court.

- The pending decision has made some rice traders and importers hesitant to import.

- The Department of Agriculture (DA) expects import arrivals to pick up in the coming weeks, potentially leading to lower retail rice prices.

Price Trends and Projections

- Current retail prices in Metro Manila:

- Imported well-milled rice: P51 to P53 per kilogram

- Regular-milled rice: P47 to P48 per kilogram

- The DA estimates that prevailing rice prices could fall below P50 per kilogram once the imported rice stocks with lower tariff rates enter the market.

Domestic rice prices have been on an upward trend since 2023, with wholesale prices for regular milled and well-milled rice reaching near-record levels. This trend is partly due to the increased cost of imports, with popular Vietnamese rice varieties (DT8 and 5451) now priced at US$625-640 per metric ton, significantly higher than early 2023 levels.

USDA Projections and Market Dynamics

The United States Department of Agriculture (USDA) projects a steady increase in Philippine rice imports:

- 2022: 3.8 million metric tons (MMT)

- 2023: 3.9 MMT

- 2024: 4.7 MMT (current year) looks unlikely though.

- 2025: 4.3 MMT (forecast)

This upward trend is primarily driven by growing consumption, expected to reach 17.1 MMT by 2025, up from 14.8 MMT in 2021.

Conclusion

The Philippines continues to rely heavily on rice imports to meet its growing domestic demand, with consumption outpacing production growth. While Vietnam remains the largest supplier, there's a clear trend towards diversification of import sources.

The country faces challenges in balancing food security, price stability, and market dynamics. The current slowdown in import arrivals, combined with policy uncertainties surrounding EO 62, creates a complex environment for both policymakers and market participants.

As the Philippines navigates these challenges, the resolution of the legal challenges to EO 62 and the potential impact of lower-tariff imports on domestic prices will be crucial factors shaping the future of the country's rice import landscape. The coming weeks will be critical in determining whether import volumes pick up as expected by the DA, and whether this leads to the anticipated reduction in retail rice prices.