In a dramatic shift that could reshape the global rice market, India, the world's leading rice exporter, is contemplating easing its export restrictions on certain rice varieties. This move, driven by a favorable monsoon and increased domestic planting, presents both opportunities and challenges for the international community. However, this potential relief for rice-importing nations is complicated by an unprecedented surge in global shipping costs, creating a perfect storm that could keep rice prices elevated despite improved availability.

The Stakes: A Delicate Balance of Supply and Cost

India's rice export policies have far-reaching implications. Since implementing restrictions in 2023, benchmark Asian rice prices have skyrocketed to 15-year highs, putting pressure on food security in regions heavily dependent on Indian rice, particularly West Africa and the Middle East.

The Proposed Changes:

1. Introduction of fixed duties on white rice exports ~ USD 100/tonne

2. Potential removal of the 20% tax on parboiled rice exports

3. Consideration of a minimum export price (MEP) of USD 500/tonne on non-basmati rice

These measures aim to prevent a domestic glut while maintaining some control over exports. However, they also risk further complicating an already volatile global rice market.

The Catalyst: A Bountiful Monsoon

Recent data paints an optimistic picture for Indian agriculture:

- 19% increase in rice acreage as of July 8 compared to last year

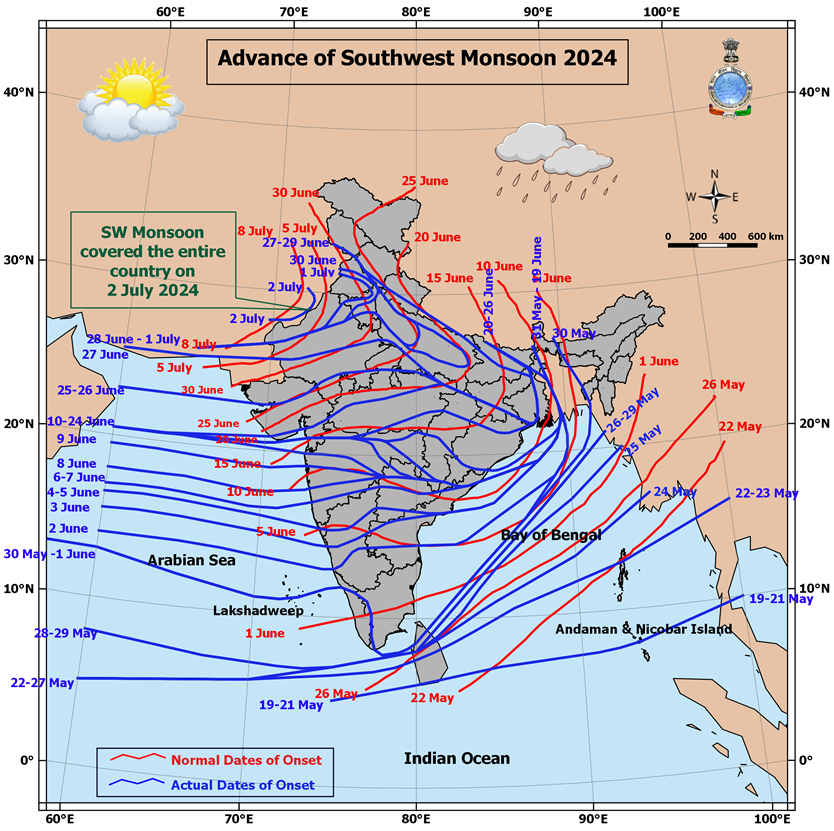

- Significant recovery in monsoon rains after a deficient June

This agricultural boom has prompted the government to reconsider its strict export policies. However, the decision is not without its complexities.

The Freight Rate Factor: A New Hurdle

Recent data shows an alarming trend in shipping costs:

- Container freight rates from Asia to the US and Europe have tripled since early 2024

- Costs have surged from $1,200 to $7,500 per container, with no ceiling in sight

This unprecedented increase in shipping costs is driven by multiple factors:

- Red Sea disruptions due to Houthi attacks

- Panama Canal drought limiting traffic

- Post-pandemic surge in global trade volumes

- Consolidation in the shipping industry

The Global Impact: A Mixed Blessing - Availability Improves, But at a Cost

For importing nations, especially in West Africa and the Middle East, India's potential policy shift could increase rice availability. However, the landed cost of rice in these regions is likely to remain high or even increase due to the freight rate surge. This creates a paradoxical situation where rice may be more available but not necessarily more affordable.

The Domestic Dilemma

While easing restrictions could prevent a domestic glut and benefit farmers, it also risks domestic price increases. The Indian government must walk a tightrope between supporting its agricultural sector and ensuring affordable food for its vast population.

The Bigger Picture: Food Security in an Uncertain World

India's rice export policies underscore the delicate balance between national interests and global responsibilities. As climate change continues to impact agricultural patterns worldwide, the decisions of major food exporters like India will become increasingly critical to global food security.

Looking Ahead: A Multifaceted Challenge

As a committee headed by Home Minister Amit Shah prepares to make crucial decisions on rice export policies, the global rice market holds its breath. The outcome will have significant repercussions not just for India, but for rice-importing nations and global food prices at large. The potential increase in rice exports from India may improve availability, but the benefits could be negated by exorbitant shipping costs.

India's potential relaxation of rice export restrictions, while a step towards increasing global supply, is not a panacea for high rice prices. The surge in freight rates adds a significant complication, likely keeping landed prices of rice elevated in importing countries despite improved availability. This situation highlights the complex interplay between domestic agriculture, international trade, logistics, and food security.

As the world grapples with climate change, geopolitical tensions, and supply chain disruptions, the decisions made in New Delhi will have far-reaching consequences. The global community must brace for a future where increased food availability may not necessarily translate to affordability, challenging our traditional understanding of food security dynamics.