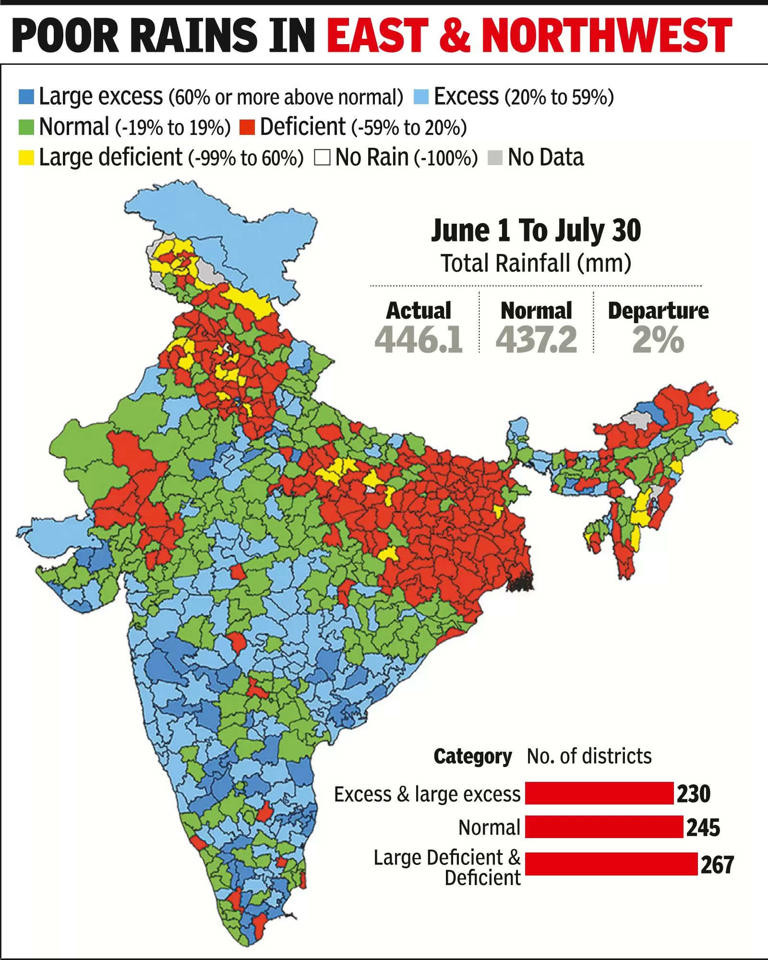

As of late July 2024, India's monsoon season continues to show significant regional disparities despite an overall excess in rainfall. This update focuses on the impact of these rainfall patterns on major rice-producing regions, including production numbers and the potential consequences of surplus or deficit rainfall.

Overall Monsoon Performance:

- July has witnessed 9-10% excess rainfall compared to the monthly average.

- The season's total rainfall is now 2% above normal.

- 36% of India's districts (267 out of 742) report deficient or 'large deficient' rainfall.

Regional Analysis and Production Impact:

1. Eastern India (Bihar, Jharkhand, Odisha, West Bengal):

Production numbers:

- West Bengal: ~15 million tons per year

- Bihar: ~8 million tons per year

- Odisha: ~8 million tons per year

- Jharkhand: ~3 million tons per year

Impact of deficit rainfall (20-49% below normal):

- Delayed sowing and potential reduction in output

- Increased reliance on groundwater for irrigation, raising sustainability concerns

- Possible decrease in overall yield, affecting the region's substantial contribution to national rice production

- Risk of pushing harvest dates later, potentially affecting the next rabi (winter) crop cycle

2. Northwest India (Punjab, Haryana):

Production numbers:

- Punjab: ~12 million tons per year

- Haryana: ~4 million tons per year

Impact of deficit rainfall (20-30% below normal):

- Less severe impact due to extensive irrigation infrastructure

- Increased groundwater pumping, exacerbating long-term water table problems

- Potential stress on high-quality Basmati rice production, affecting both domestic and export markets

- Possible reduction in overall yield if deficit persists

3. Central India (Chhattisgarh, Madhya Pradesh):

Production numbers:

- Chhattisgarh: ~7 million tons per year

- Madhya Pradesh: ~4 million tons per year

Impact of normal to surplus rainfall:

- Normal sowing progress and rice growth

- Potential to offset some losses from other deficit areas

- Improved conditions in Madhya Pradesh, with deficit districts reduced from 18 to 5 between July 11 and July 25

- Possibility of increased yields if favorable conditions persist

4. Southern Peninsula (Andhra Pradesh, Tamil Nadu):

Production numbers:

- Andhra Pradesh: ~13 million tons annually

- Tamil Nadu: ~7 million tons per year

Impact of surplus rainfall (26% above normal):

- Risk of localized flooding affecting crop establishment and growth

- Increased pest and disease pressure due to high humidity and excess moisture

- Potential for higher yields if excess rainfall doesn't lead to significant crop damage

- Possible quality issues affecting market value of the produce

Expected Challenges and Implications:

1. Yield Variations: With significant rainfall deficits in areas producing over 40 million tons annually (Eastern and Northwestern regions), there's a high likelihood of reduced overall rice production, even with better performance in Central and Southern regions.

2. Water Management: Deficit regions, especially Punjab and Haryana (16 million tons combined annual production), face increased pressure on groundwater resources, raising long-term sustainability concerns.

3. Crop Quality: Stress from water scarcity in deficit areas and excess moisture in surplus regions could affect rice quality, impacting both domestic consumption and export potential, particularly for premium varieties like Basmati.

4. Food Security and Export Policy: The government may need to maintain a cautious approach to rice exports, especially considering the risk to production in major contributing states like West Bengal (15 million tons) and Bihar (8 million tons).

5. Regional Adaptation: Farmers in deficit areas may need to consider short-duration rice varieties or alternative crops, while those in surplus areas might require improved drainage and pest management strategies.

Looking Forward

1. August Rainfall: Critical for deficit areas in Eastern and Northwestern India, which contribute over 45 million tons of rice annually.

2. La Nina Formation: Its timing and strength could bring relief to rain-starved areas but may exacerbate surplus conditions in already well-watered regions.

3. Policy Flexibility: The government may need to adjust import/export policies and provide targeted support based on regional production outcomes.

Conclusion

The 2024 monsoon's uneven distribution presents a complex scenario for India's rice production. With major producing regions facing contrasting challenges of deficit and surplus rainfall, the country's overall rice output and quality are at risk. Careful monitoring, region-specific interventions, and adaptive policies will be crucial to managing the impacts on food security, farmer livelihoods, and India's position in the global rice market. The situation underscores the need for long-term strategies to enhance the resilience of India's rice production systems in the face of increasingly unpredictable monsoon patterns.