Container Markets in Turmoil - HIGH Rates and Lack of Availability Impacting Rice Trade

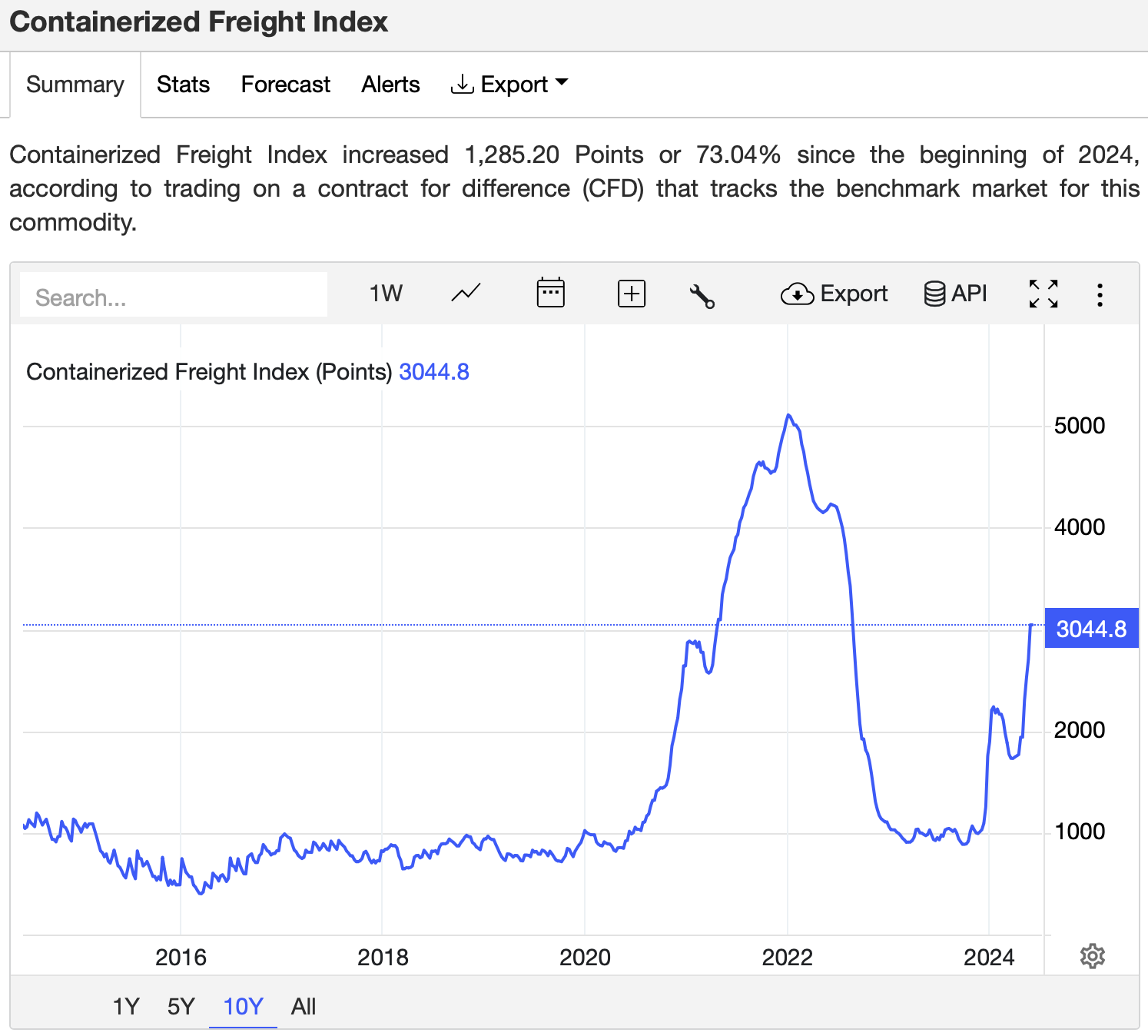

The global container shipping industry is facing severe disruptions, with heated freight rates and a lack of container availability. This turmoil is being driven by several factors, including the impact of U.S. sanctions on China, which is affecting trade flows and causing congestion at key redistribution ports. Seems like we are back ini COVID era for high freight rates.

After several weeks of complaints from traders about the difficulties in finding vessels and containers, the situation has become dire. Container rates are climbing to levels approaching pandemic peaks, which directly impacts the bottom line and effectively raises the cost of imports. Rice imports are already USD100-150 per metric ton higher than the cheapest sources at the same time last year.

"This reality is a blessing for anyone with inventory at destination markets," said one trader, who noted that inventory levels are also running low, compounding the challenges and leading to higher prices.

The rice trade has been cautious, with buyers reluctant to take on risk amidst uncertainty about India reopening exports, the return of the Philippines' National Food Authority (NFA), and recent approval of a 15% import duty in the Philippines which is forecast to import 4 million mt in 2024 and 5 million mt in 2025. Now, the logistics challenges are adding even more heat to the market.

One major factor is the ongoing shipments from Bulog, the Indonesian national food procurement agency, which are tying up vessels and causing congestion and delays at technically challenging ports. Additionally, some vessels are avoiding the Suez Canal due to the impact of U.S. sanctions on Chinese exports, leading to longer transit times and port congestion at hubs like Singapore.

Container rates are heating up as vessels avoid the Suez Canal, and the added element of U.S. sanctions on Chinese exports seems to have changed the flow of trade. Ports like Singapore, where it used to take 2-3 days to transfer and transit, are now taking 10 days. The global rice trade and consumers around the world are facing up to these latest challenges.

While breakbulk shipping remains a better option for rice traders, getting vessels has been a challenge, particularly for suppliers to Indonesia. Breakbulk freight for Bulog tenders are ranging from USD 28-40/mt from Vietnam to Indonesian main ports.

The collective impact seems to emanate from challenges in the Red Sea region, translating to slower or a lack of Suez Canal shipments, which means longer vessel routes and more ton-miles – effectively increasing demand as vessels are in use for longer periods.

The influence of congestion caused by the U.S. sanctions on Chinese exports and its impact across the supply chain is also a significant factor. Container availability is being hit hard, and transshipment centers are facing delays and congestion as the global trade adapts to significant changes in how shipping is utilized, particularly container shipping adapting to changes in trade patterns involving China.

"It seems clear that a slow China means fewer containers positioned to be available for most any other trade," said an industry analyst. "Blank sailings by the shipping lines are the biggest reason for problems in Asia. Freight rates from Indian main ports to Cotonou in Benin are now quoted at USD 2,400 per forty-foot container compared to USD 1,200 just a month back. It's a very difficult time for Indian rice exporters, and the forecast for the coming weeks is challenging."

As the rice trade grapples with these logistics challenges, traders and consumers alike are bracing for continued disruptions and higher costs in the global rice market.