China, the world's largest rice producer and consumer, is facing significant challenges to its rice crop due to extreme weather events in 2024. The country's quest for food security is being tested as record-breaking heat waves and flooding impact major agricultural regions.

Impact on Rice Production:

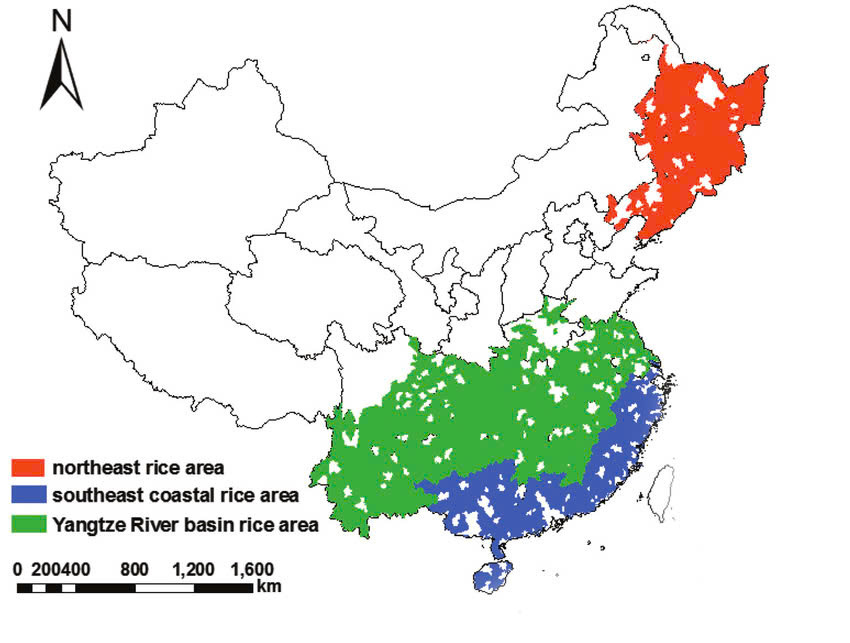

Scorching temperatures exceeding 40°C have hit several rice-growing provinces, including Hubei, Hunan, Jiangxi, Anhui, and Zhejiang. This extreme heat coincides with the harvest of the early-season rice crop, raising concerns about potential damage and reduced yields.

The Chinese government has taken steps to mitigate the impact, issuing 238 million yuan (approximately $32.8 million) in emergency funding to help recover agricultural production in five affected provinces.

Weather Extremes:

China is experiencing its most severe flood season since record-keeping began in 1998, with 25 significant flood events recorded so far this year. The national rainfall average is 13.3% higher than usual, with some river basins receiving double the average precipitation.

July 2024 was recorded as the hottest month in China's history, with an average air temperature of 23.21°C, surpassing the previous record set in 2017.

Potential Impact on Imports:

While specific import figures are not provided in the given information, the extreme weather conditions could potentially lead to increased rice imports if domestic production falls short. China's push for food self-sufficiency may be challenged, especially considering its need to feed a population of 1.4 billion people.

Factors that could influence imports include:

1. Crop damage: Extensive flooding and heat damage to rice crops may reduce domestic supply, necessitating imports to meet demand.

2. Food security concerns: The Chinese government's focus on food security might lead to preemptive imports to ensure adequate rice supplies.

3. Global market uncertainty: Increasing occurrences of extreme weather events worldwide could affect the global rice market, potentially impacting both the availability and prices of imports.

Mitigation Efforts:

Chinese authorities are taking steps to minimize the impact on rice production:

1. Increased irrigation to keep fields cool during heat waves.

2. Guidance for farmers to re-plant crops destroyed by flooding.

3. Efforts to improve the agriculture sector's capacity for disaster prevention and reduction.

4. Plans to increase output in unaffected farmland to compensate for losses in damaged areas.

As China navigates these weather-related challenges, the coming months will be crucial in determining the overall impact on its rice production and whether increased imports will be necessary to maintain food security for its vast population.