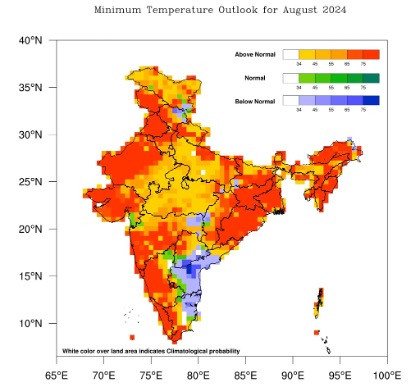

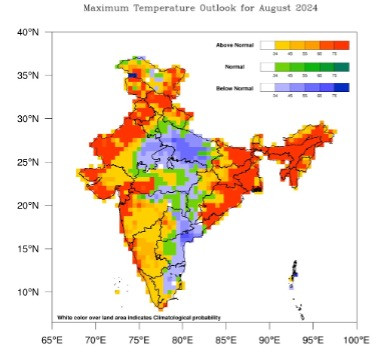

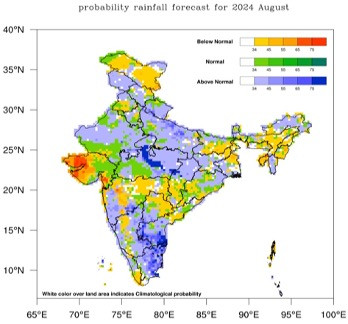

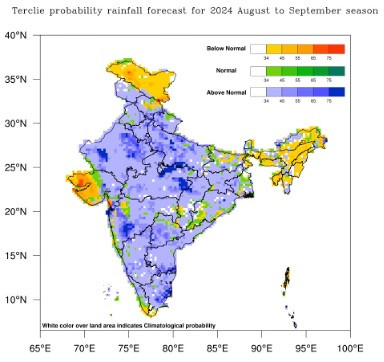

The India Meteorological Department's (IMD) latest forecast for August-September 2024 paints a complex picture for India's rice production, potentially reversing fortunes in key growing regions. With overall rainfall expected to exceed 106% of the long-period average, the outlook appears promising at first glance. However, a closer examination reveals significant regional variations that could dramatically impact rice output across the country.

Eastern India: Potential Turnaround in the Rice Bowl if Rainfall forecasts for Aug-Sep hold true

The eastern rice bowl, initially struggling with 20-49% below-normal rainfall, may see a shift:

- West Bengal (15 million tons/year)

- Bihar (8 million tons/year)

- Odisha (8 million tons/year)

- Jharkhand (3 million tons/year)

While these states face a rainfall deficit, the August-September forecast suggests improved conditions. However, IMD chief Mrutyunjay Mohapatra warns that parts of northeast and adjoining areas of east India may still see below-normal rainfall, leaving uncertainty for this 34-million-ton production powerhouse.

Northwest: Continued Challenges for Premium Rice

Punjab (12 million tons/year) and Haryana (4 million tons/year), crucial for Basmati production, may face ongoing difficulties:

- Current deficit: 20-30% below normal

- August-September forecast: Potential for below-normal rainfall in some parts

This outlook raises concerns for the premium rice sector, potentially impacting both domestic and export markets for high-quality Basmati.

Central India: Maintained Momentum

Central states are expected to continue their positive trend:

- Chhattisgarh (7 million tons/year)

- Madhya Pradesh (4 million tons/year)

The forecast predicts normal to above-normal rainfall for much of central India, supporting continued good production prospects in these regions.

Southern Peninsula: Excess Rainfall Concerns

Southern states grappling with surplus rainfall may see continued challenges:

- Andhra Pradesh (13 million tons/year)

- Tamil Nadu (7 million tons/year)

With the southern peninsula forecast to receive above-normal rainfall, risks of localized flooding, increased pest pressure, and quality issues persist.

La Nina Factor

The IMD indicates a strong possibility of La Nina conditions forming by August's end. This phenomenon typically correlates with good monsoon rainfall in India, potentially bringing relief to previously rain-starved areas. However, it may exacerbate surplus conditions in already well-watered regions.

Regional Variations and Implications

Despite the overall positive forecast, Mohapatra emphasized that below-normal rainfall is likely in:

- Many parts of northeast and adjoining areas of east India

- Ladakh

- Saurashtra & Kutch

- Some isolated pockets of central and peninsular India

These variations could lead to significant differences in rice production across regions, potentially affecting India's overall output and export capabilities.

Looking Ahead

The August-September rainfall will be crucial for the country's rice production, especially in deficit areas in Eastern and Northwestern India, which contribute over 45 million tons of rice annually. While the forecast suggests potential recovery in some regions, others may continue to struggle.

With 36% of India's districts reporting deficient or largely deficient rainfall, the country faces a complex challenge. The potential for reduced output in major producing regions like West Bengal (15 million tons) and Bihar (8 million tons) could force a reevaluation of export policies to balance domestic food security with international market commitments.

This complex scenario underscores the need for adaptive policies and region-specific interventions. The government may need to reassess its export strategies, particularly considering the production risks in major contributing states.

As India navigates this dynamic 2024 monsoon season, the coming months will be pivotal in determining the fate of its rice production and its position in the global rice market. The situation highlights the increasing importance of resilient agricultural practices and water management strategies in the face of variable monsoon patterns.