• Population: 86 mn

• Total area: 33.1 mn. ha

• Agricultural land: 9.4 mn. ha

• Arable land: 6.54 mn. ha

• Forestry land: 13 mn. Ha

• Rice land: 3.9 mn. ha

• Sown area: 7.4 mn. ha

• Paddy Yield: 43 MMT

• Rice Exports: 8 MMT (3rd largest globally)

Vietnam's Rice Industry: A Cornerstone of Agriculture and Economy

Rice cultivation has been an integral part of Vietnam's rich agricultural heritage for centuries. Blessed with fertile lands, abundant water resources from the Mekong River Delta and Red River Delta regions, and a tropical monsoon climate conducive to rice farming, Vietnam has emerged as a global powerhouse in rice production and export.

The rice industry in Vietnam plays a pivotal role in the country's economy, contributing significantly to food security, employment, and foreign exchange earnings. With a population of over 97 million, rice remains the staple food for the majority of Vietnamese households, making domestic demand a critical factor shaping the industry's dynamics.

Rice farming in Vietnam can be traced back to the ancient Dong Son culture, which flourished around the 7th century BC. Over the centuries, traditional rice cultivation methods were passed down from generation to generation, evolving and adapting to the changing times and advancements in agricultural practices.

During the French colonial era and the subsequent wars, Vietnam's rice production faced numerous challenges, including land redistribution, labor shortages, and infrastructure damage. However, in the post-reunification period, the government implemented significant reforms, such as the Doi Moi policy in 1986, which paved the way for a revitalized and modernized rice industry.

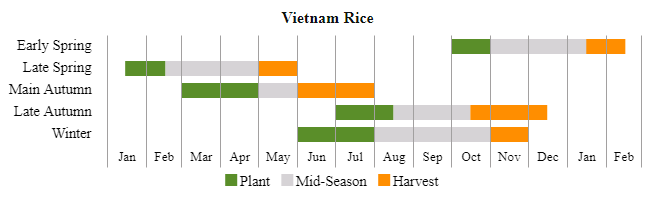

Production and Cultivation

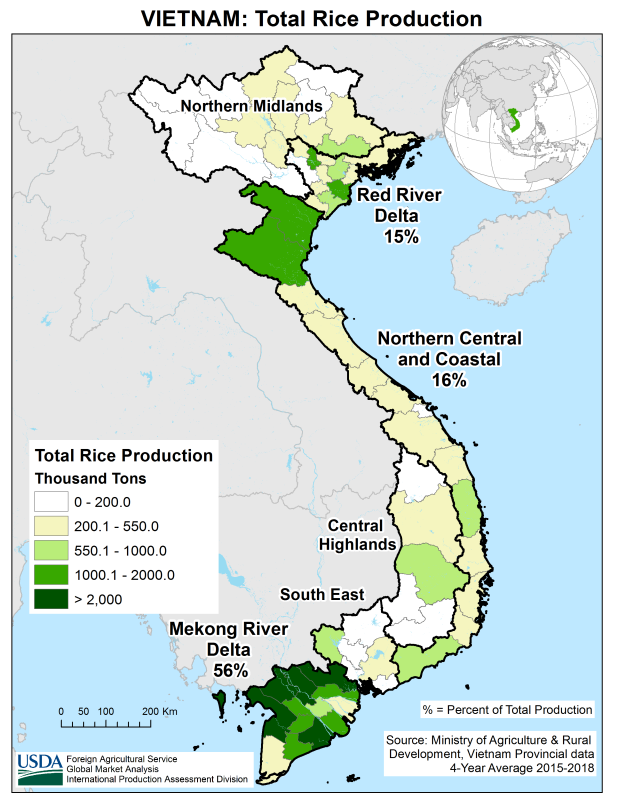

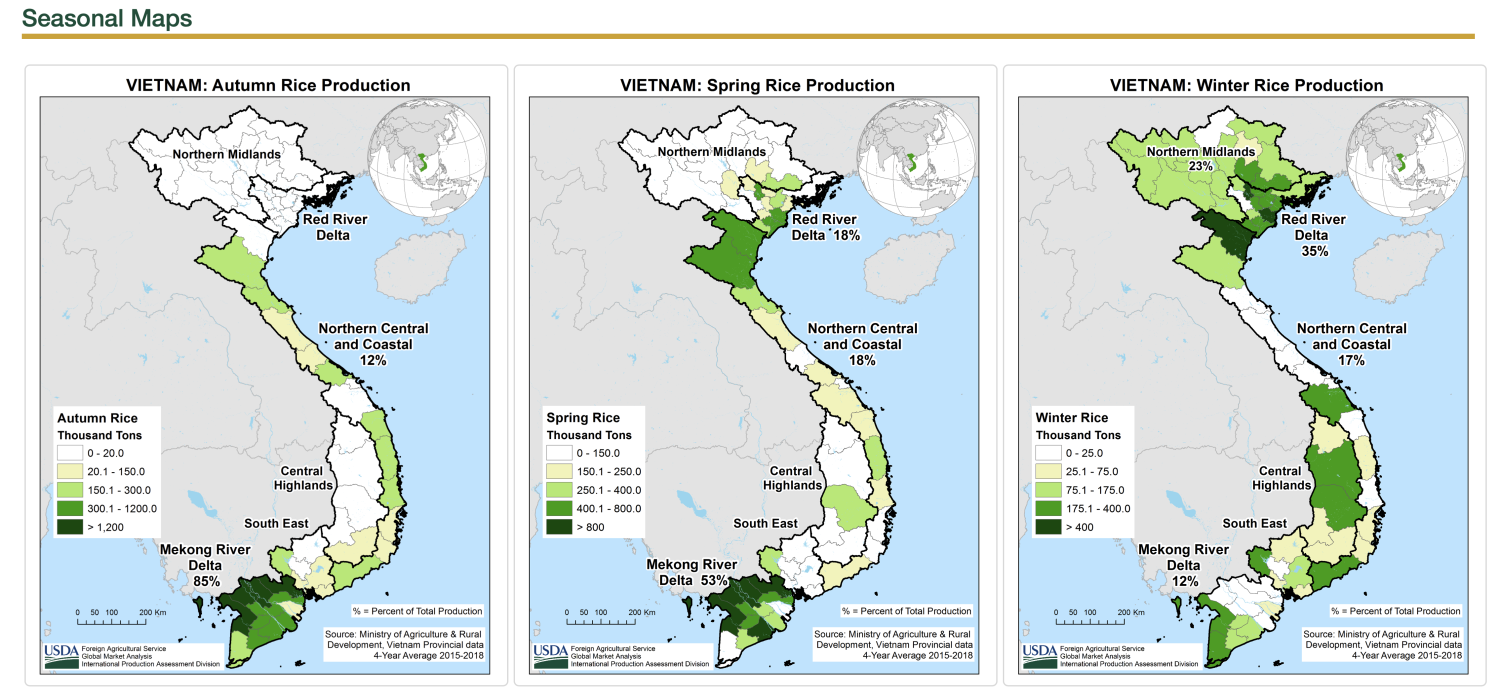

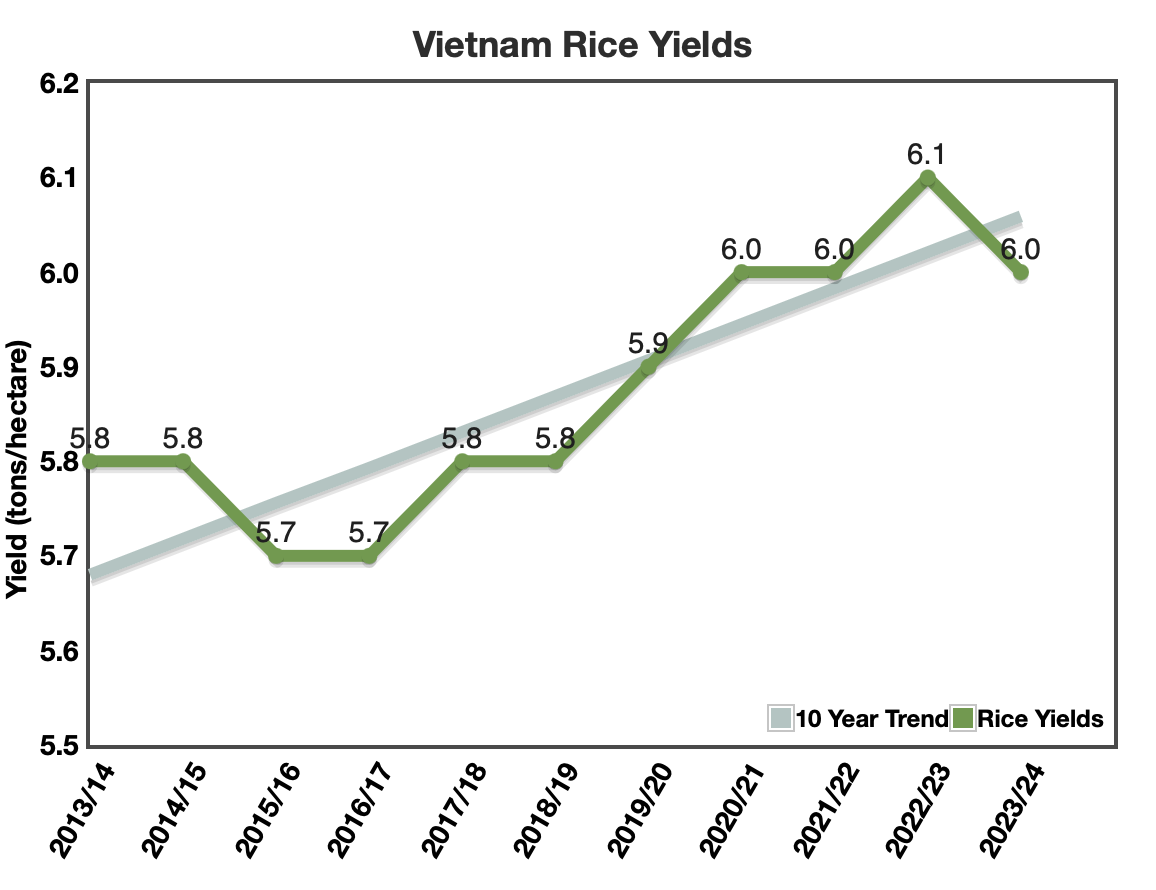

Vietnam is one of the world's leading rice producers, with an annual production of around 44 million metric tons as of 2023. The country's rice cultivation is primarily concentrated in the Mekong River Delta and Red River Delta regions, which account for over 90% of the total rice production.

The Mekong River Delta, situated in the south, is renowned for its fertile alluvial soils and extensive irrigation systems, making it a prime location for rice farming. The Red River Delta in the north, with its rich sedimentary soils and cooler climate, also contributes significantly to Vietnam's rice production.

Vietnam's rice cultivation is characterized by a combination of traditional methods and modern techniques. While many small-scale farmers still employ manual labor and age-old practices, larger commercial operations have embraced mechanization, high-yielding seed varieties, and advanced irrigation and pest management strategies to boost productivity and efficiency.

Total rice consumption (19.57 mmt) is increasing at 0.90% annually, resulting from population growth, as per capita consumption declines by 0.06% per year.

• The local market is mostly unbranded sales of white rice and other fragrant rice

• However, this is changing rapidly as large rice millers are pushing significant efforts at branded sales of high-quality fragrant rice.

Varieties and Exports

Vietnam is known for producing a diverse range of rice varieties, catering to both domestic and international markets. The country's flagship rice exports are the high-quality jasmine and Vietnamese fragrant rice, which are highly sought after in international markets for their distinct aroma and flavor.

Jasmine Rice

Jasmine rice, also known as Thai fragrant rice, is one of Vietnam's most popular rice varieties for export. It is characterized by its long grains, delicate aroma, and slightly sticky texture when cooked. Vietnam's jasmine rice is renowned for its high quality and is a preferred choice in many Asian countries, particularly in Southeast Asia.

Vietnamese Fragrant Rice

Vietnamese fragrant rice is a collection of numerous long-grain aromatic varieties like DT8, OM18, Nang Hoa, and others that have gained popularity globally. They are prized for fragrant aroma, slightly nutty flavor, and fluffy texture when cooked. Vietnamese fragrant rice is often marketed under names like "Vietnam Pandan Rice" or "Jasmine Perfumed Rice."

Sticky Rice (Glutinous Rice)

Sticky rice, also known as glutinous rice, is a staple in Vietnamese cuisine and holds significant cultural importance. This short-grain rice variety becomes sticky and chewy when cooked, making it ideal for dishes like bánh chưng (sticky rice cake) and xôi (sticky rice with various toppings). While primarily consumed domestically, sticky rice is also exported to cater to the demand from Vietnamese diaspora communities and Asian markets.

Japonica Rice

In addition to the popular aromatic varieties, Vietnam also produces japonica rice, a short-grain rice variety commonly used in East Asian cuisines. Vietnamese japonica rice is known for its stickiness and is often used in sushi, rice balls, and other Japanese and Korean dishes. This variety is primarily exported to Northeast Asian markets, such as Japan, South Korea, and China.

Rice Exports and Key Markets

Over the past decades, Vietnam has emerged as a major rice exporter, consistently ranking among the top three global rice exporters, alongside India and Thailand. In 2023, Vietnam exported approximately 8 million metric tons of rice.

Vietnam's key rice export markets include:

1. China: As Vietnam's largest rice export market, China imported over 2.2 million metric tons of rice from Vietnam in 2021, primarily jasmine and fragrant rice varieties.

2. Philippines: The Philippines is another significant importer of Vietnamese rice, with a strong demand for jasmine and sticky rice varieties.

3. African Countries: Vietnam has established a strong presence in several African markets, including Ivory Coast, Ghana, and Senegal, exporting both white and fragrant rice varieties.

4. Middle Eastern Countries: Markets like Iran, Iraq, and the United Arab Emirates are important destinations for Vietnamese rice exports, driven by the demand for high-quality aromatic rice varieties.

5. ASEAN Markets: Vietnam also exports rice to neighboring Southeast Asian countries, such as Malaysia, Singapore, and Indonesia, catering to the diverse culinary preferences within the region.

To maintain its competitive edge in the global rice trade, Vietnam has focused on improving quality standards, investing in processing and milling technologies, and promoting its premium rice varieties through branding and marketing efforts. Additionally, the country has actively pursued free trade agreements and partnerships to expand market access and boost rice exports.

Challenges

Despite its remarkable success, the Vietnamese rice industry faces several challenges that could impact its future growth and sustainability:

1. Climate Change: Rising temperatures, erratic rainfall patterns, and sea-level rise pose significant threats to rice cultivation, particularly in the low-lying Mekong Delta region, which is vulnerable to saltwater intrusion and flooding.

2. Water Management: Increasing water scarcity and competition for water resources among agricultural, industrial, and domestic sectors could strain Vietnam's rice production, necessitating improved water management strategies and irrigation infrastructure.

3. Land Fragmentation: The prevalence of small-scale rice farms and land fragmentation can hinder productivity, mechanization, and economies of scale, potentially impacting the industry's competitiveness in the global market.

4. Environmental Concerns: Excessive use of fertilizers, pesticides, and water resources in rice cultivation has raised environmental concerns, prompting calls for more sustainable and eco-friendly farming practices.

5. Trade Barriers and Market Access: Fluctuations in global rice prices, trade policies, and market access restrictions in key export destinations can significantly impact Vietnam's rice export revenue and profitability.

Government Policies and Future Outlook

Recognizing the strategic importance of the rice industry, the Vietnamese government has implemented various policies and initiatives to support and develop the sector. These include:

1. Investment in Research and Development: Funding for agricultural research to develop high-yielding, stress-resistant, and disease-resistant rice varieties, as well as promoting advanced farming techniques.

2. Infrastructure Development: Investments in irrigation systems, storage facilities, and transportation infrastructure to improve productivity, reduce post-harvest losses, and facilitate domestic and international trade.

3. Market Diversification: Efforts to diversify export markets and explore new potential markets to reduce reliance on a few key destinations and mitigate trade risks.

4. Sustainability Initiatives: Promotion of sustainable and eco-friendly farming practices, such as integrated pest management, water-saving technologies, and organic rice cultivation, to address environmental concerns and meet evolving consumer preferences.

Looking ahead, Vietnam's rice industry is poised to continue playing a crucial role in the country's economic development and food security. However, addressing the challenges posed by climate change, resource constraints, and evolving market dynamics will be critical to ensuring the industry's long-term sustainability and competitiveness in the global rice trade.

Vietnam Fragrant Brokens Exports

Vietnam Regional Exports to Asia