The Philippines Rice Industry

Rice is a staple food in the Philippines, deeply ingrained in the country's culture and economy. With a population of over 110 million people and a rising demand for rice, the Philippines has long been one of the world's largest importers of this crucial grain. This article delves into the intricate dynamics of the Philippines rice industry, exploring its past, present, and future, as well as the key players and challenges shaping its trajectory.

Historical Context

The Philippines has a long and rich history of rice cultivation, dating back to the pre-colonial era. Rice farming has been an integral part of the country's agricultural landscape, with various indigenous methods and practices passed down through generations. However, despite its agricultural heritage, the Philippines has struggled to achieve self-sufficiency in rice production, relying heavily on imports to meet domestic demand.

In the past, the Philippines had a state-controlled rice trading system, with the National Food Authority (NFA) being the sole importer and distributor of rice. This system was intended to ensure food security and stabilize prices, but it was often criticized for its inefficiency, corruption, and distortion of market forces.

The Rice Tariffication Law of 2019

A significant turning point for the Philippines rice industry came in 2019 with the introduction of the Rice Tariffication Law (RTL). This law abolished the NFA's import monopoly and replaced quantitative restrictions on rice imports with tariffs. The tariff rate for rice imports was set at 35%, with the aim of fostering a more competitive and transparent market.

The RTL was widely praised for its potential to lower consumer prices, increase market efficiency, and promote a more vibrant domestic rice industry. However, its implementation has not been without challenges, as concerns over food security, farmer welfare, and the potential return of the NFA have emerged.

Import Demand and Key Players

The Philippines continues to be a major importer of rice, with demand driven by rising consumption and limited domestic production growth. The country's rice imports are projected to reach 4.1 million metric tons (MMT) in 2024 and 4.3 MMT in 2025, up from 3.9 MMT in 2023.

Vietnam has traditionally been the largest supplier of rice to the Philippines, accounting for 80% of imports in 2023 and 59% in the first quarter of 2024. There has been a shift in import sources, with Thailand, Pakistan, and Myanmar gaining greater market share due to better availability and competitive pricing.

Key players in the Philippines rice import market include large trading companies, millers, and retailers. They play a crucial role in sourcing and distributing imported rice to meet domestic demand.

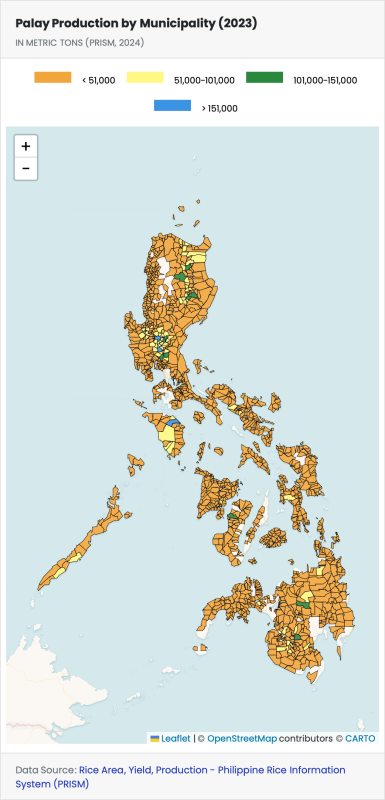

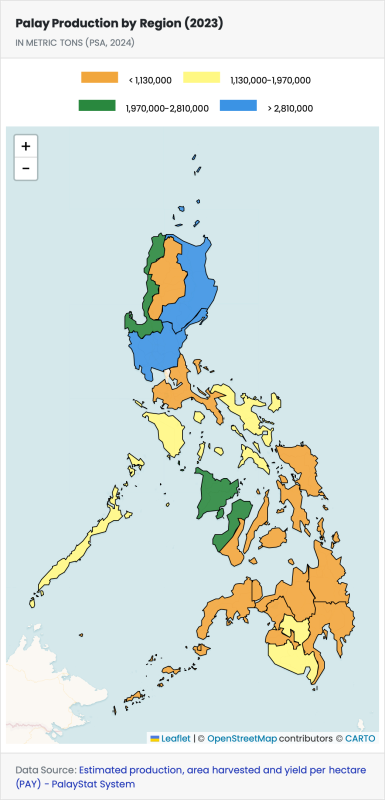

Domestic Production and Challenges

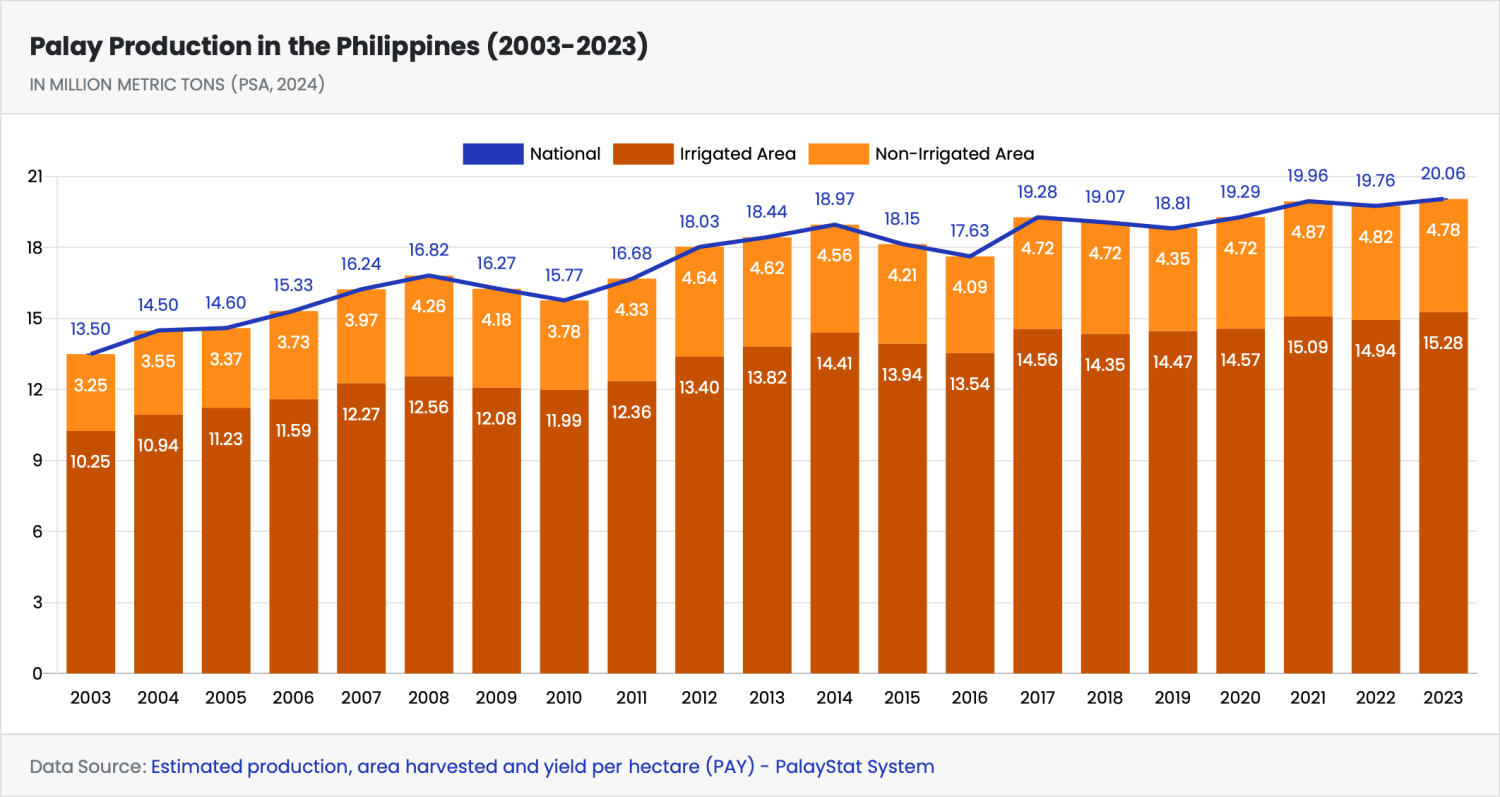

Despite being an agricultural nation, the Philippines has struggled to keep pace with its rising rice consumption. USDA data, which projects the country's rice production (in milled rice equivalent) to reach 12.7 MMT in 2025, a modest increase from 12.5 MMT in previous years.

Several factors contribute to the Philippines' limited rice production growth, including:

1. Limited arable land and fragmented land holdings

2. Vulnerability to natural disasters and climate change

3. Aging farmer population and lack of incentives for younger generations

4. Inadequate infrastructure and irrigation systems

5. Limited access to modern farming technologies and inputs

To address these challenges, the Philippine government has implemented various programs and initiatives aimed at boosting domestic rice production. These include the Rice Competitiveness Enhancement Fund (RCEF), which provides support to smallholder farmers through access to high-quality seeds, machinery, and credit facilities.

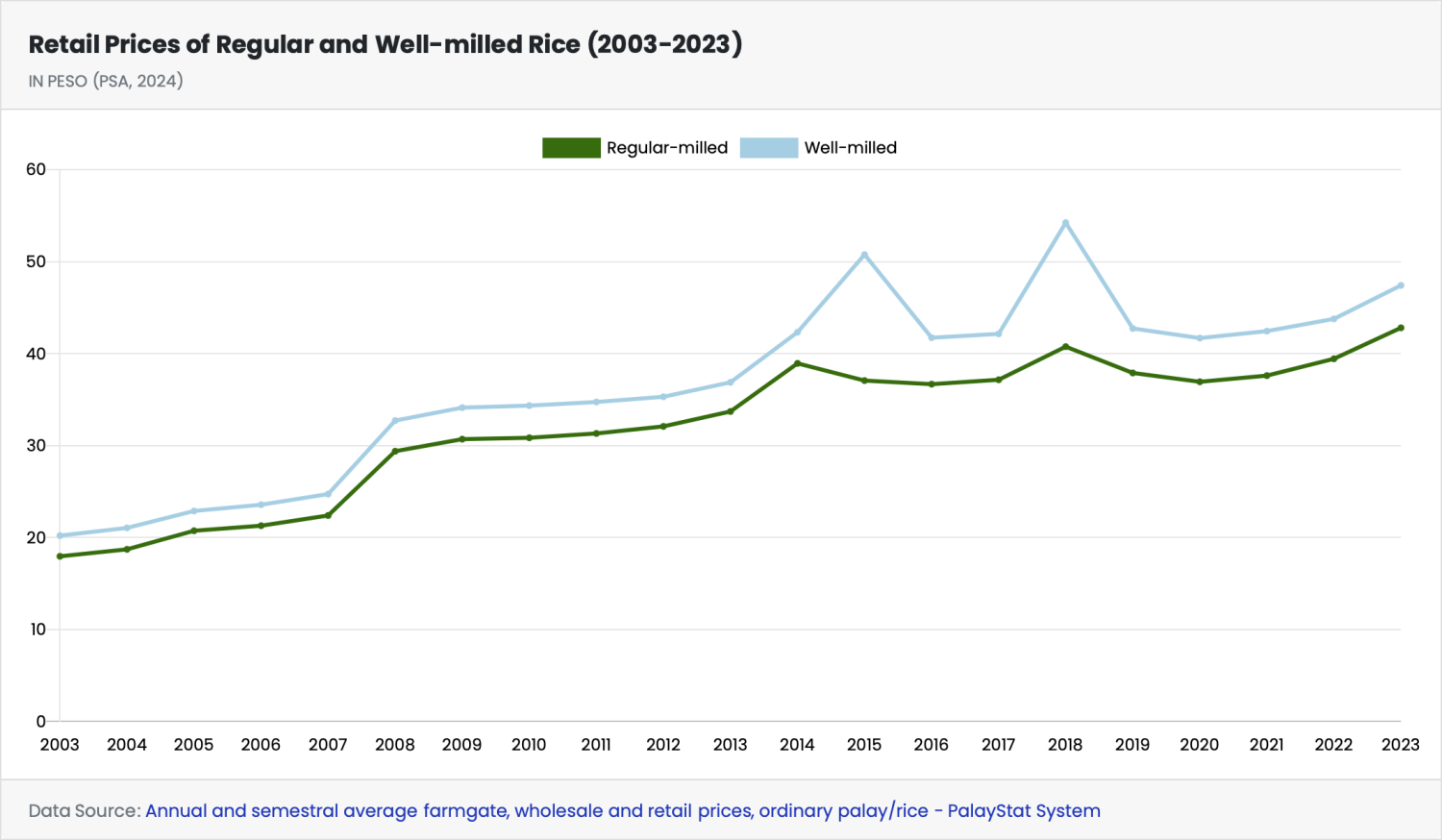

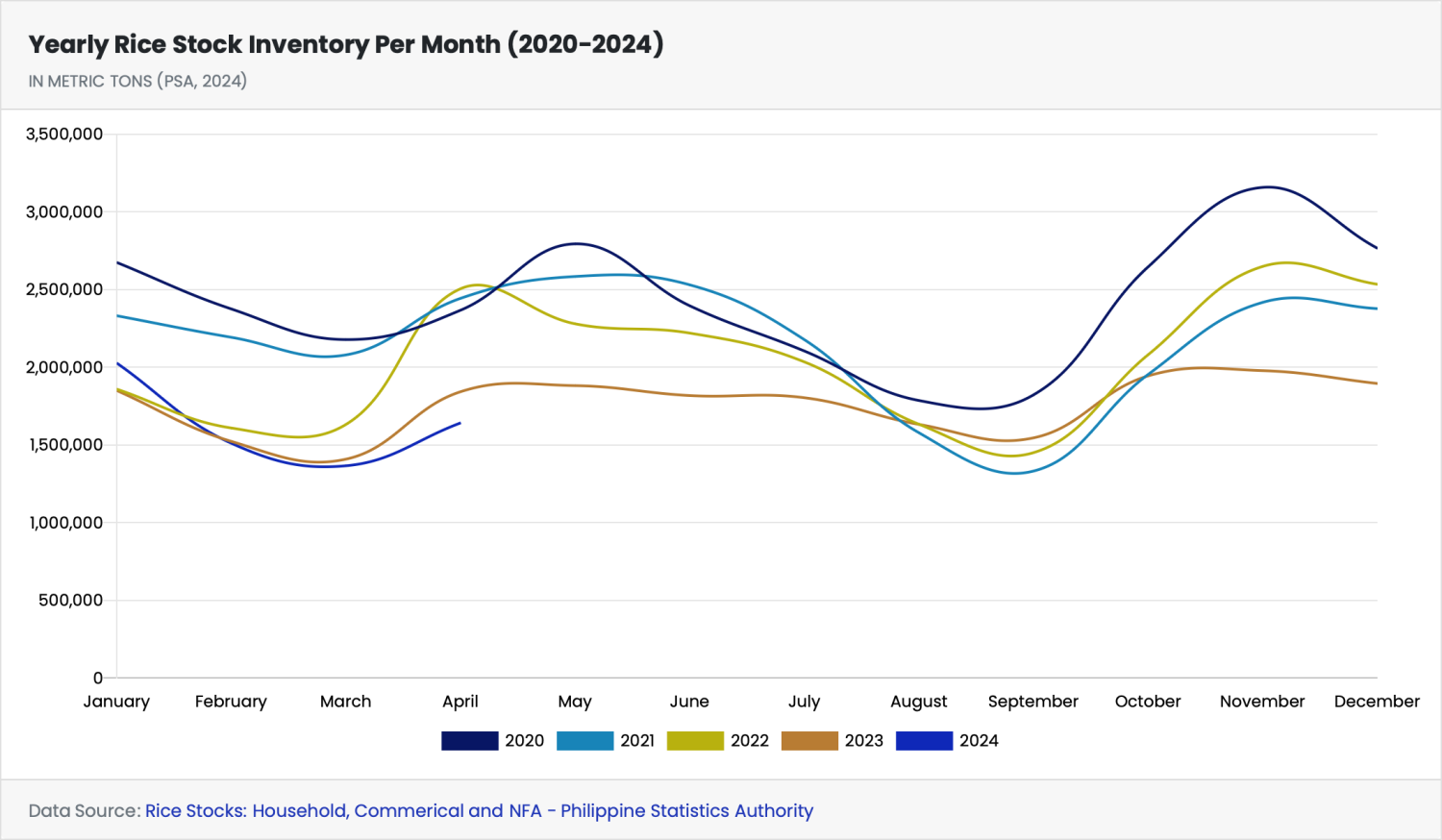

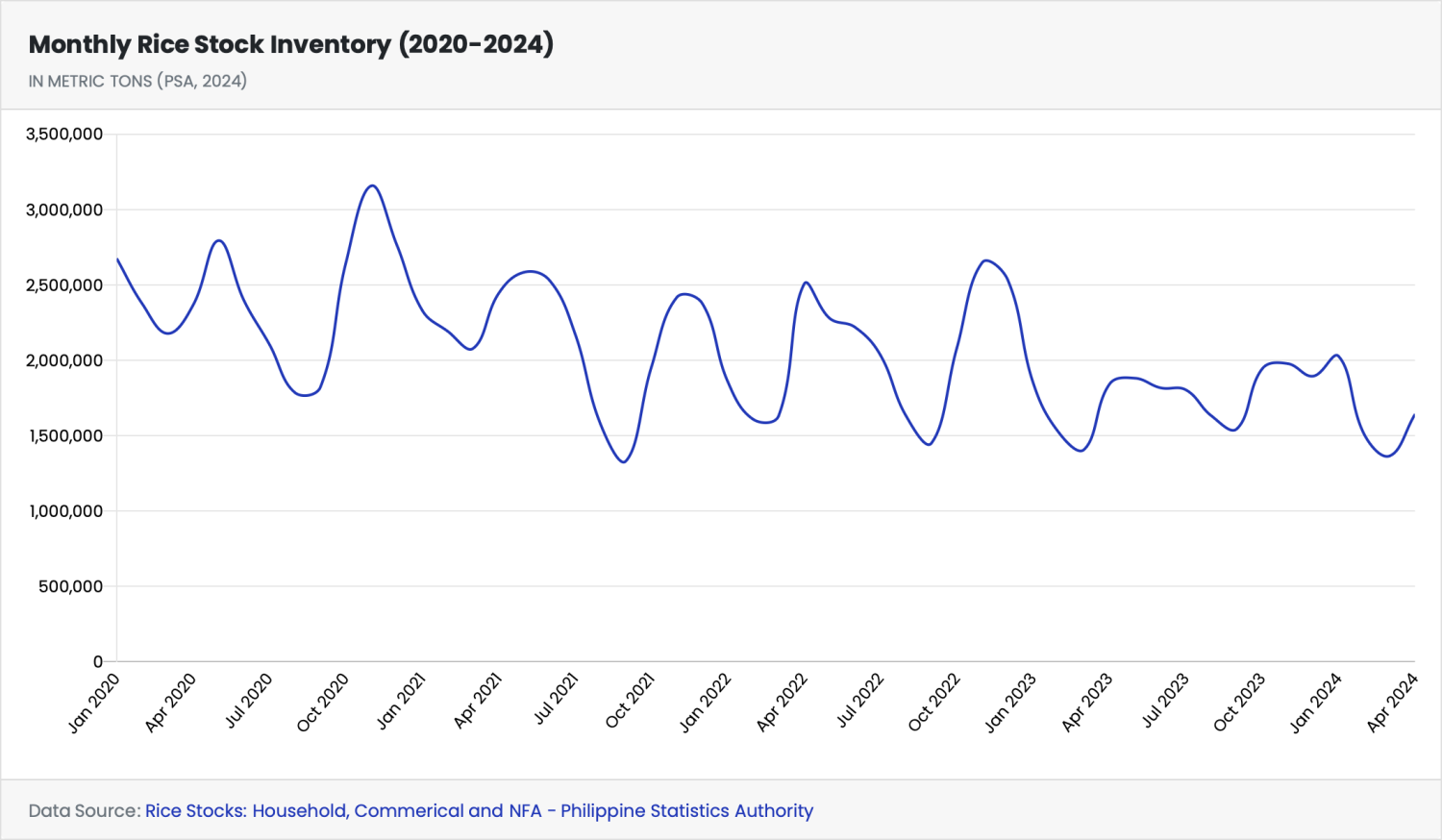

Stocks and Prices

There are concerns over the Philippines' rice stock levels, which are reported to be at their weakest levels ahead of the lean season (June to August). As of April 2024, the country's total rice stocks stood at 1.64 MMT, with the NFA holding only 42,000 MT, commercial stocks at 663,000 MT, and household stocks at 938,000 MT. These levels are lower than the corresponding figures from April 2023, indicating potential tightness in supply during the lean period.

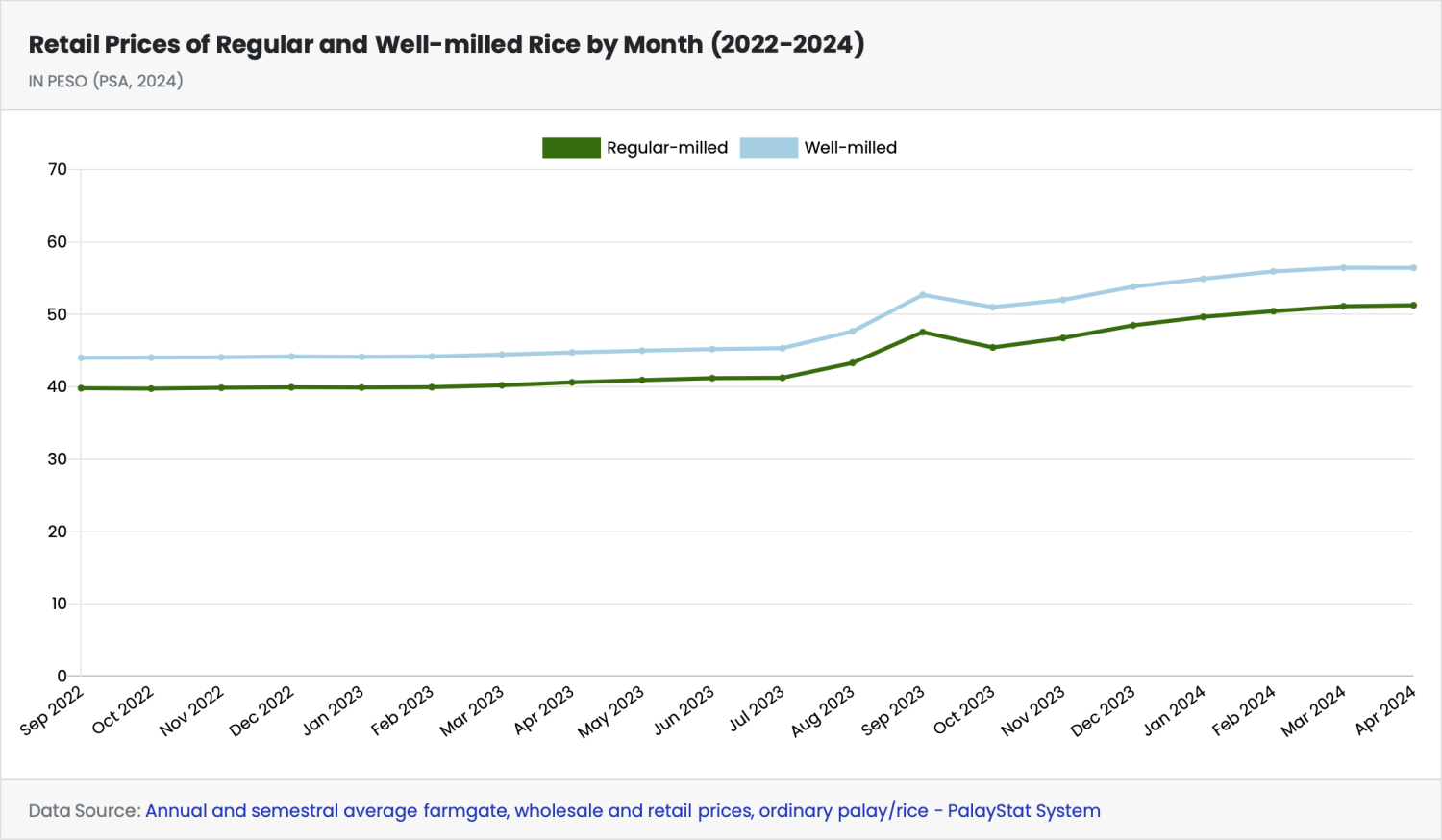

Rising domestic prices and the weak Philippine peso (PHP) have contributed to higher costs for imported rice, exacerbating inflationary pressures. Popular rice varieties, such as DT8 and 5451, being priced at $625-640 per metric ton (PMT) in 2024, significantly higher than the $525-550 PMT range observed in early to mid-2023.

The Future Outlook

Proposed Amendments to the Rice Tariffication Law

There have been efforts to amend the 2019 Rice Tariffication Law, potentially reintroducing the NFA's role in rice imports. These proposed amendments, supported by President Ferdinand Marcos Jr., have raised concerns among market participants and importers, leading to a slowdown in fresh import commitments as they await clarity on the policy changes.

The potential return of the NFA and changes to import tariffs have reignited debates over food security, market distortions, and the efficiency of state-controlled trading systems. While some argue for the NFA's reintroduction to ensure stable prices and food availability, others caution against potential inefficiencies and market distortions.

Addressing Domestic Production Challenges

To reduce reliance on imports and achieve greater self-sufficiency, the Philippines must address the longstanding challenges facing its domestic rice production. This may involve:

1. Investing in modern agricultural technologies and infrastructure

2. Encouraging younger generations to pursue rice farming through incentives and training

3. Implementing sustainable farming practices and climate-resilient crop varieties

4. Improving access to credit and financing for smallholder farmers

5. Strengthening land tenure systems and consolidating fragmented land holdings

By addressing these issues, the Philippines can potentially boost domestic rice production, reducing import dependency and enhancing food security.

Potential Policy Reforms

Beyond the proposed amendments to the Rice Tariffication Law, reducing import tariffs could provide short-term relief to consumers and mitigate inflationary pressures. However, concerns persist regarding potential under-invoicing practices to evade tariff payments, highlighting the need for robust monitoring and enforcement mechanisms.

Policymakers may also explore alternative policy measures, such as targeted subsidies, crop insurance schemes, or income support programs, to safeguard farmer livelihoods while promoting a more competitive and efficient rice market.

Conclusion

The Philippines rice industry stands at a crossroads, with significant challenges and opportunities on the horizon. While import demand remains strong due to rising consumption and limited production growth, the proposed amendments to the Rice Tariffication Law have introduced uncertainties and raised concerns among market participants.

Addressing domestic production challenges, investing in modern agricultural technologies, and implementing sustainable farming practices will be crucial to reducing import dependency and enhancing food security. Additionally, policymakers must strike a balance between promoting a competitive market, ensuring affordable prices for consumers, and safeguarding the livelihoods of Filipino rice farmers.

As the Philippines navigates these complex issues, collaboration among stakeholders, including farmers, importers, policymakers, and civil society organizations, will be essential to shaping a sustainable and resilient rice industry that meets the nation's food security needs while fostering economic growth and social stability.

Other key data points and charts to note -

- Total rice production grows at 2.08% annually, 1.73% of which comes from yield improvement and 0.34% from an increase in area harvested.

- Total rice consumption (12.39 MMT) is growing at 1.54% per year due to population growth, as per capita consumption declines by 0.23% annually.

- About 20% of domestic rice consumption is sourced from imports, although the government has long been trying to attain self-sufficiency.

- Despite projected gains in rice output, the country is expected to remain a rice importer as the population continues to grow and a safe level of stocks is maintained for food security.

- Tariffs for imported rice are expected to be 40-50% at the minimum thereby creating an artificial high price in the local markets