Pakistan's Rice Industry: A Staple Crop with Global Reach

Rice is one of the most important crops cultivated in Pakistan, serving as a staple food for a large portion of the population and a major export commodity. Pakistan's rice industry plays a vital role in the country's agricultural sector, contributing significantly to the national economy and providing employment opportunities for millions of people. This article delves into the various aspects of Pakistan's rice industry, including its history, production, varieties, trade dynamics, challenges, and future prospects.

Historical Background

Rice cultivation in the regions that now constitute Pakistan dates back to ancient times. Archaeological evidence suggests that rice was grown in the Indus Valley Civilization as early as 2500 BC. Over the centuries, rice farming evolved and became an integral part of the agriculture practices in the region. During the British colonial era, efforts were made to improve rice cultivation techniques and introduce new varieties, laying the foundation for the modern rice industry in Pakistan.

Production

Pakistan is one of the world's leading rice producers, ranking among the top ten countries in terms of rice production. The country's rice cultivation is primarily concentrated in the provinces of Punjab and Sindh, which account for over 90% of the total production. The major rice-growing areas in Punjab include the districts of Gujranwala, Sheikhupura, Sialkot, and Hafizabad, while in Sindh, the rice belt stretches across districts like Larkana, Qambar Shahdadkot, and Naushahro Feroze.

The production of rice in Pakistan is heavily dependent on the availability of water resources, particularly from the Indus River basin and its tributaries. Irrigation systems play a crucial role in ensuring adequate water supply for rice cultivation. The introduction of high-yielding varieties, improved agricultural practices, and the use of modern farming techniques have contributed to the steady growth of rice production in Pakistan over the past few decades.

Varieties

Pakistan is renowned for its diverse range of rice varieties, which cater to both domestic and international markets. The two main categories of rice grown in the country are Basmati and non-Basmati (coarse) varieties.

Basmati Rice:

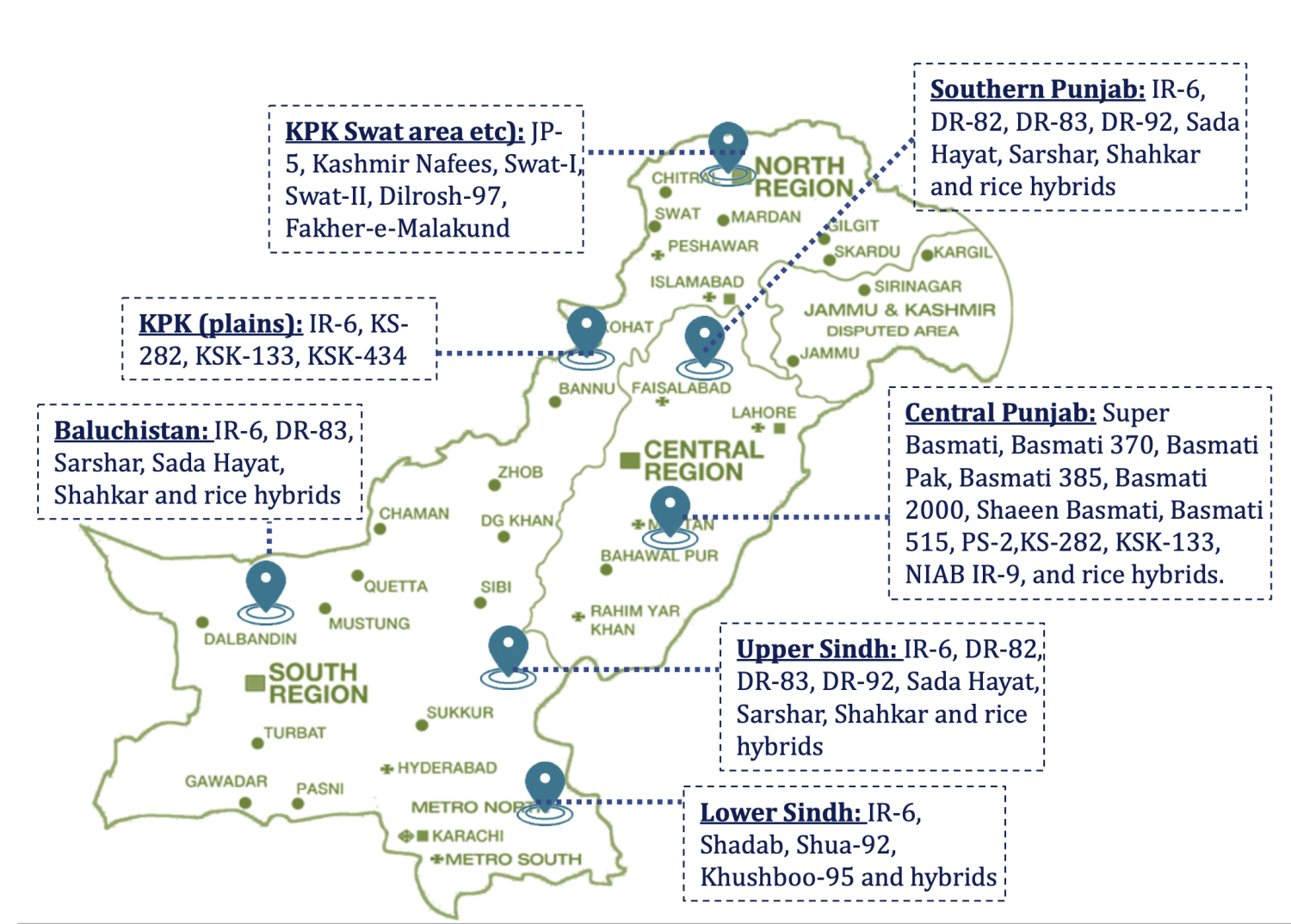

Basmati rice is a premium, long-grain aromatic rice that is highly prized for its unique flavor, aroma, and elongation properties. Pakistan, along with India, is one of the few countries that can produce authentic Basmati rice. The major Basmati varieties cultivated in Pakistan include Super Basmati, Basmati 370, Basmati Pak, Basmati 385, Basmati 2000, and Sheen Basmati. Basmati rice is primarily grown in the Punjab region and is a highly sought-after commodity in international markets, particularly in the Middle East, European Union, and North America.

Non-Basmati Rice:

Non-Basmati or coarse rice varieties are primarily grown in the Sindh region of Pakistan. These varieties are known for their high yields, resistance to pests and diseases, and suitability for various culinary applications. Some popular non-Basmati varieties include IRRI-6, DR-82, DR-83, DR-92, Sada Hayat, Sarshar, and Shahkar. These varieties are widely exported to African and Asian countries, where they serve as a staple food for millions of people.

Trade Dynamics

Rice exports play a crucial role in Pakistan's economy, contributing significantly to the country's foreign exchange earnings. Pakistan is one of the world's leading rice exporters, with its rice being exported to over 100 countries across the globe.

Basmati Rice Exports:

Pakistan's Basmati rice is highly sought after in international markets, particularly in the Middle East, European Union, and North America. The unique aroma, flavor, and quality of Pakistani Basmati rice have earned it a premium status, commanding higher prices compared to other rice varieties. The major export destinations for Pakistani Basmati rice include the United Arab Emirates, Saudi Arabia, the United Kingdom, and the United States.

Non-Basmati Rice Exports:

Pakistan's non-Basmati rice varieties are primarily exported to African and Asian countries. The major export destinations for non-Basmati rice include China, Malaysia, Kenya, Afghanistan, Mozambique, Tanzania, and Benin. The competitive pricing and high yields of Pakistan's non-Basmati rice varieties have made them popular choices in these markets.

In addition to exports, Pakistan's domestic rice market is also significant, with the country's growing population and changing dietary preferences contributing to increased domestic consumption.

Rice, being the second main staple food item and second major exportable commodity after cotton, contributed ~21.9% of value added in agriculture and ~0.4% to GDP during FY23. However, rice production during the year declined by ~21.5% YoY. This increased back up in FY 24.

Rice is a Kharif crop, with sowing season ranging May-June, growing season during July-September and harvest season from October-December. Of the total Rice production, ~52% is produced in Punjab, ~38% in Sindh and remaining ~8% in Balochistan.

In FY23, Rice production stood at ~7.3mln MT (FY22: ~9.3mln MT), declining by ~21.5% YoY. This resulted from crop damage as a result of massive flooding in Aug’22 which ravaged parts in Southern Punjab, Sindh and Balochistan. Area under cultivation, thus reduced to ~3.0mln Ha in FY23 (FY22: ~3.5mln Ha). in FY 24 the planted area and total output jumped significantly to surpass even FY 22 numbers.

Steep ~39% devaluation of PKR against the USD in FY23 helped retain Pakistan’s Rice competitiveness in the global Rice markets and contributed to export revenue in PKR terms. Revenue from Rice exports stood at USD~2.1bln.

- Area Under Cultivation: Average area under cultivation over the past five years (FY19-23) stood at ~3.1mln Ha. In FY23, area under Rice cultivation declined to ~3.0mln Ha (FY22: ~3.5mln Ha) with a YoY fall of ~14%. This can be attributed to the destruction caused by the floods of Aug’22 (~1.78mln Ha of total crops were damaged).

- Local Production: Average local Rice production over the past five years (FY19-23) stood at ~7.9mln MT . In FY23, Rice production was recorded at ~7.3mln MT (FY22: ~9.3mln MT), a YoY decrease of ~21.5%.

- Local Consumption: Average local Rice consumption over FY19-23 stood at ~3.8mln MT . In FY23, however, Rice consumption was estimated at ~3.6mln MT (FY22: ~4.3mln MT), showing a YoY decrease of ~16.3%.

- Exports: Average Rice exports during FY19-23 were recorded at ~4.1mln MT . In FY23, Rice exports were down by ~26.0% YoY, clocking in at ~3.7mln MT (FY22: ~5.0mln MT). Although export prices remained competitive due to the average PKR depreciation of ~39% in FY23, the quantitative decrease in Rice exports was caused by low local production.

- Projections: Rice production forecasts for Pakistan have been revised up from ~7.3mln MT to ~9.0mln MT for FY24 (USDA), YoY increase of ~23.3%. Area under cultivation is forecast to increase to ~3.5mln Ha in FY24. Yield is expected to increase to ~2.6 MT/Ha in FY24 from ~2.4 MT/Ha.

- As per USDA, Rice exports are forecast to clock in at ~5.0mln MT in FY24 (FY23: ~3.7mln MT) mainly owing to exports of Non-Basmati rice which are expected to improve in the presence of India’s current ban on its exports for the commodity with effect from Jul’23.

- Pakistan has two major rice-producing regions; Punjab and Sindh. Together, both provinces account for nearly ~90% of total rice production.

- Punjab, due to its agri-climatic and soil conditions, produces 100% of the Basmati rice in the country, which is a premium quality and expensive rice as compared to non basmati/coarse rice.

- Sindh region is enriched with cultivation of Non-Basmati/coarse rice, mainly IRRI-6, which is majorly exported to the African regions.

- Sindh region is further bifurcated into two parts due to differing land characteristics and water

- availability, hence the quality differs according to the varieties.

Challenges and Opportunities

While Pakistan's rice industry has achieved remarkable success, it also faces several challenges that need to be addressed to ensure its long-term sustainability and growth.

Water Scarcity and Climate Change:

Pakistan's rice cultivation heavily relies on irrigation systems, making it vulnerable to water scarcity and the impacts of climate change. Erratic rainfall patterns, rising temperatures, and the depletion of groundwater resources pose significant threats to rice production. Adopting water-efficient irrigation techniques, developing drought-resistant rice varieties, and implementing effective water management strategies are crucial to mitigating these challenges.

Yield Gaps and Technology Adoption:

Despite the availability of high-yielding rice varieties and modern agricultural practices, there exists a significant yield gap between the potential and actual yields achieved by Pakistani farmers. Bridging this gap requires increased investment in research and development, promoting the adoption of advanced agricultural technologies, and providing better access to high-quality inputs and training for farmers.

Pest and Disease Management:

Rice cultivation in Pakistan is susceptible to various pests and diseases, which can severely impact yields and quality. Developing robust integrated pest management strategies, promoting the use of bio-pesticides, and breeding disease-resistant rice varieties are essential for ensuring sustainable rice production.

Market Access and Trade Barriers:

While Pakistan's rice exports have grown significantly, the industry faces challenges in accessing certain international markets due to trade barriers and stringent quality standards. Strengthening phytosanitary measures, improving post-harvest handling techniques, and fostering collaboration with international partners can help overcome these hurdles and expand market access for Pakistani rice.

Value Addition and Diversification:

Pakistan's rice industry has traditionally focused on the export of raw rice. However, there is a need to diversify and explore opportunities for value addition, such as the development of ready-to-eat rice products, rice-based snacks, and other value-added rice-based products. This can help increase export earnings, create employment opportunities, and contribute to the overall growth of the rice industry.

Future Prospects

Despite the challenges, Pakistan's rice industry holds immense potential for future growth and development. The following factors are expected to shape the industry's trajectory in the coming years:

Increasing Global Demand:

With the world's population projected to reach 9.7 billion by 2050, the global demand for rice is expected to rise significantly. Pakistan, with its favorable climatic conditions and vast rice-growing areas, is well-positioned to meet this growing demand, both in domestic and international markets.

Technological Advancements:

The integration of modern agricultural technologies, such as precision farming, remote sensing, and biotechnology, can revolutionize rice cultivation in Pakistan. These advancements can lead to higher yields, improved resource efficiency, and better pest and disease management, ultimately enhancing the competitiveness of Pakistani rice in global markets.

Sustainable Production Practices:

Adopting sustainable production practices, such as conservation agriculture, organic farming, and integrated nutrient management, can help mitigate the environmental impacts of rice cultivation while ensuring long-term productivity and resilience to climate change.

Strengthening Value Chains:

Investing in robust value chains, including efficient post-harvest handling, storage facilities, and processing infrastructure, can help reduce wastage, improve quality, and enhance the value-addition potential of Pakistani rice.

Government Support and Policies:

Continued government support through favorable policies, investment in research and development, and the provision of incentives and subsidies can play a crucial role in fostering the growth of Pakistan's rice industry and ensuring its long-term sustainability.

Looking ahead

Pakistan's rice industry is a vital component of the country's agricultural sector, contributing significantly to food security, employment, and export earnings. With its diverse range of rice varieties, favorable climatic conditions, and rich agricultural heritage, Pakistan has the potential to solidify its position as a leading player in the global rice market. However, addressing challenges such as water scarcity, yield gaps, pest and disease management, and market access barriers is essential to ensure the industry's long-term success. Through a combination of technological advancements, sustainable production practices, value addition, and supportive government policies, Pakistan's rice industry can continue to thrive and contribute to the country's economic growth and development.