• Population: 1.25 bn

• Total area: 328.7mn. ha

• Agricultural land: 157.5 mn. ha

• Arable land: 155 mn. ha

• Irrigated land: 82.6 mn. ha

• Forestry land: 70 mn. ha

• Rice land: 44.1 mn. ha

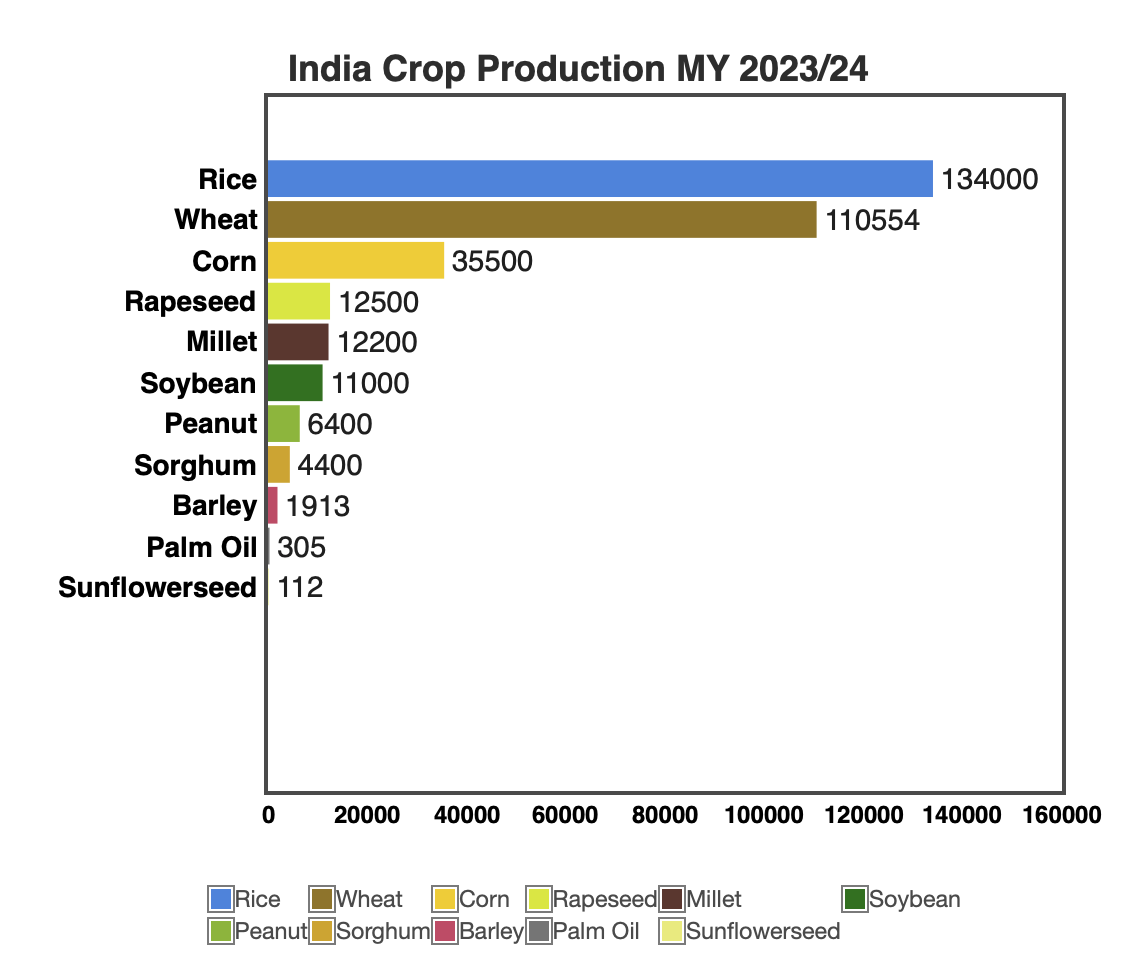

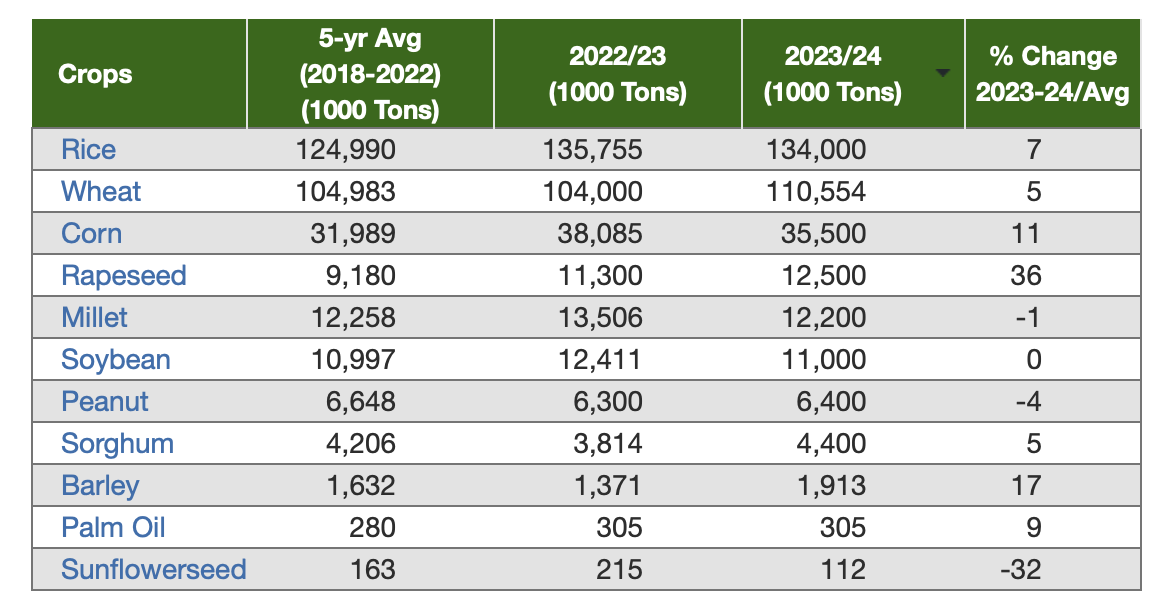

• Paddy Yield: 157 MMT

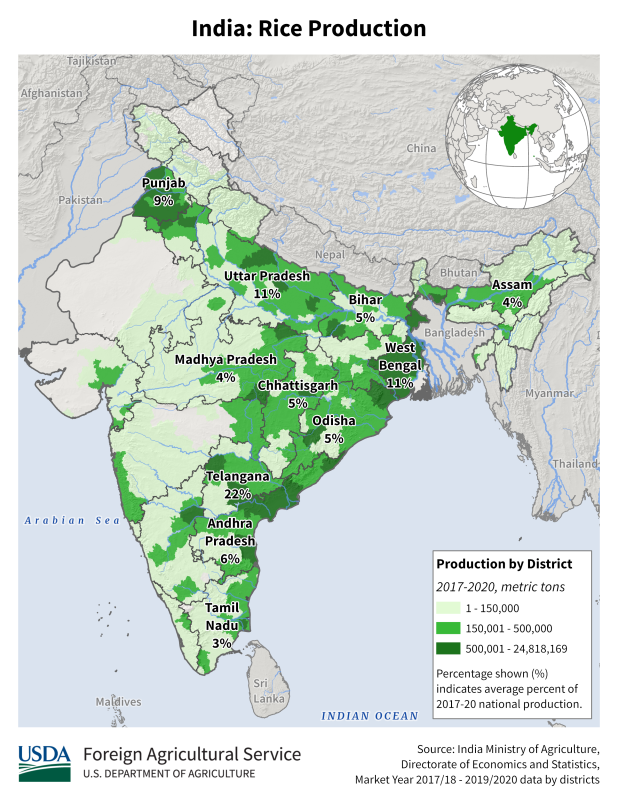

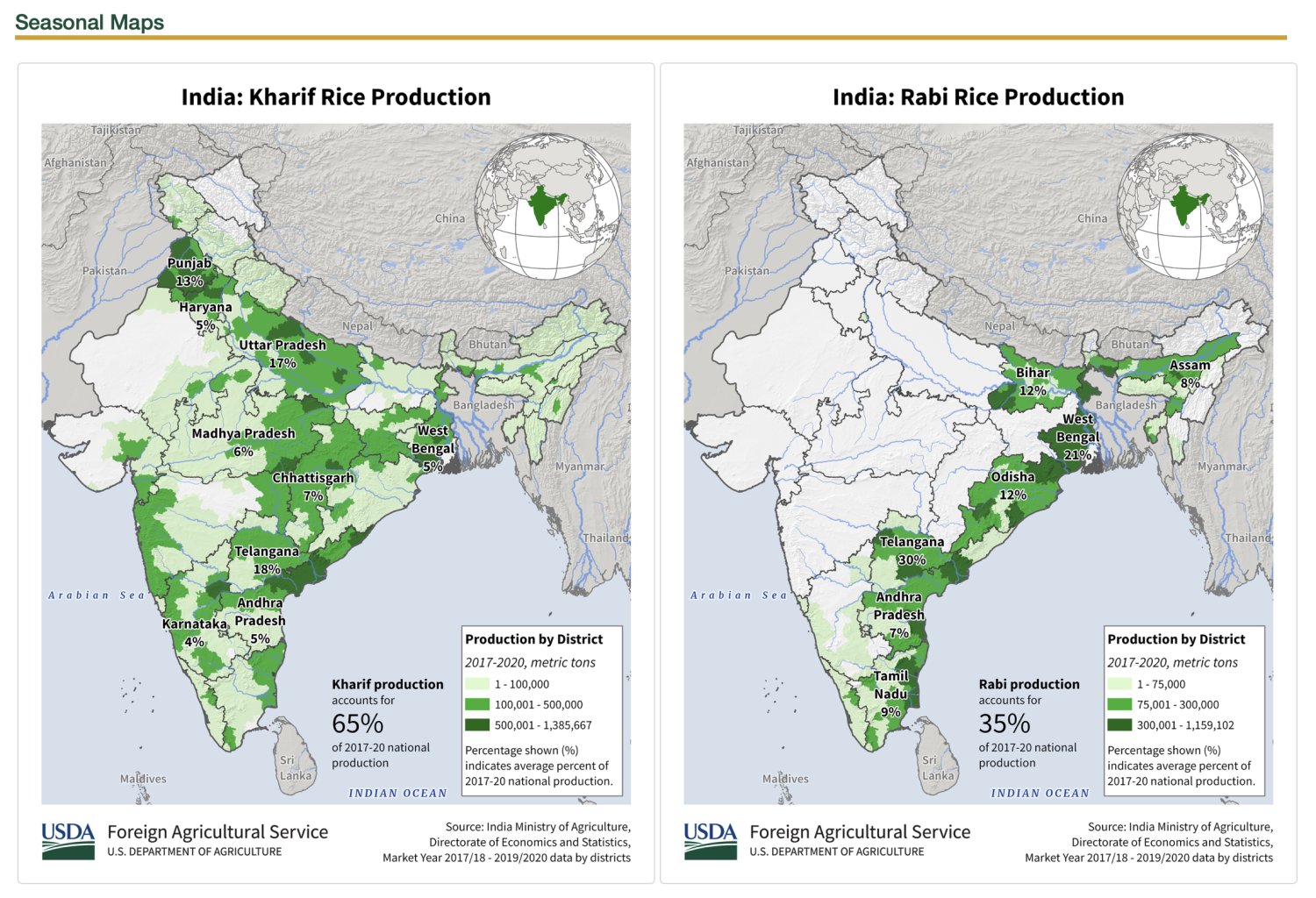

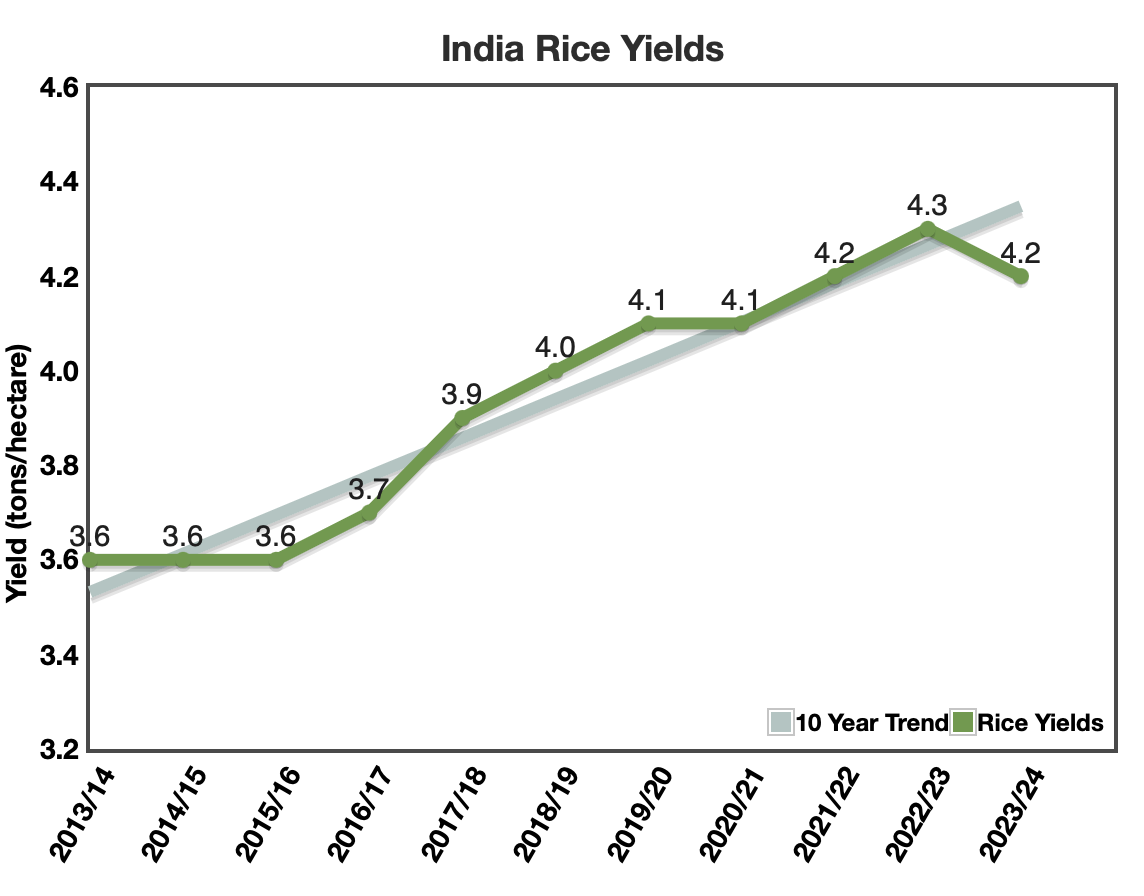

India’s long-grain Basmati rice is cultivated in the north Indian states of Punjab, Haryana, West Uttar Pradesh, Uttarakhand and Himachal Pradesh. Rice is the most important food crop in India contributing to more than 40 % of total food grain production and cultivated/consumed across the country. Rice is predominantly a rainfed crop planted in the kharif season after the onset south-west monsoon rains during June through August. However, there is a small rabi crop, mostly irrigated, planted in the states of West Bengal, Andhra Pradesh, Odisha and Tamil Nadu. India’s rice production shows a steady upward trend but subject to wider year-on-year fluctuations compared to wheat as only 60 % of the crop is irrigated.

Rice is the major staple food for more than 70 % of the Indian population with more than 4,000 varieties and hybrids of rice grown throughout the country to cater to varied consumer preferences, typically consumed as boiled rice or variants with various additives (flavors, pulses, vegetables, meat, etc.). Some rice is also used for processed products like snacks (puffed rice), savories and bakery items. With the growing economy and expanding Indian middle class, Indian consumers are increasingly diversifying their diet to include higher value and nutritious food instead of the basic staple food like boiled rice and various variants (flavored rice, biryani etc.).

Most rice retained by farmers (50 %), after saving some quantities for seed use for the next season, is also custom milled for home consumption and small quantities for feed use (mostly lactating cows and buffaloes). Some of the paddy is procured by the organized milling sector for producing milled rice for the hotels, restaurants and institutional sector and a small share for branded and packaged rice. The livestock feed industry, including poultry and aquaculture, uses de-oiled rice bran and broken rice from the milling industries.

Rice is also the most important food grain critical for the government’s Public Distribution System (PDS) and other food security programs with the government consistently purchasing about 30-35 % of the total production in the last few years and anecdotal evidence suggests approx. 60% for the 2023-24 year.

Indian Production of food grains is quite high at the moment, but climate change is pushing the government of the day to be cautious in exporting much of it.

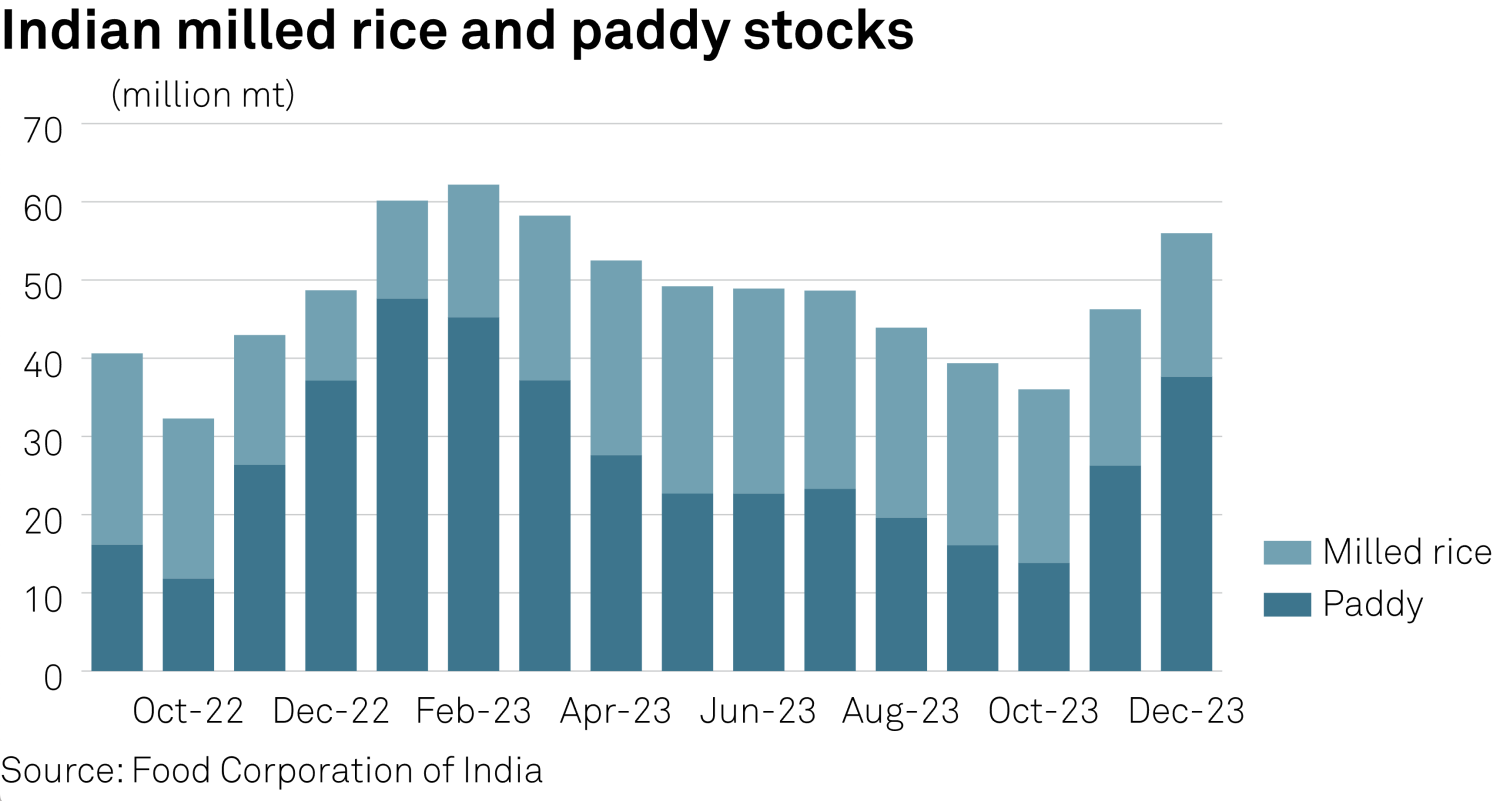

India exports of 16.95 mmt of rice in 2023 down from 22.25 mmt in

2022 (24% or 5.3 mmt less) as stocks have fluctuated significantly and election year of 2024 approached.

Rice consumption (approx. 100 mmt) is growing at slightly over 1 % pa, resulting from population growth, as per capita use declines by 0.16% per year.

• Consumer Acceptance of packaged dried goods is increasing.

• Increasing brand awareness

• Value added products made of rice are gaining traction.

• Growing propensity to spend and desire for convenience is driving margins

• The consumption pattern of Indians is shifting from cereals towards protein-rich diets, among cereals, the traction is towards better quality products. This is reflected in consumer shift towards packaged, branded products with better colour, grain size and post cooking attributes like aroma and taste.

• Consumption of branded rice is growing in both southern as well as northern India. However, the grains being sold in the south are smaller in size are mainly non-Basmati.

Challenges and Future Outlook:

The Indian rice industry faces several challenges, including:

- Climate Change and Water Scarcity: Erratic weather patterns, droughts, and depleting groundwater resources pose threats to rice cultivation and productivity.

- Stagnating Yield Growth: Despite increases in production, yield growth has slowed down in recent years, necessitating the adoption of improved technologies and farming practices.

- Price Volatility: Fluctuations in rice prices due to various factors, including production levels, trade policies, and global market conditions, can impact farmer incomes and consumer affordability.

- Quality and Sustainability: Maintaining quality standards, reducing post-harvest losses, and promoting sustainable farming practices are ongoing challenges.

To address these challenges, the Indian government and stakeholders in the rice industry are focusing on initiatives such as:

- Promoting climate-resilient and water-efficient farming practices.

- Investing in research and development of high-yielding and stress-tolerant rice varieties.

- Improving storage and logistics infrastructure to reduce post-harvest losses.

- Encouraging contract farming and farmer producer organizations for better market linkages and price realization.

- Strengthening the Public Distribution System and food safety regulations.

Despite the challenges, the Indian rice industry remains a vital component of the country's agricultural sector, contributing significantly to food security, employment, and economic growth. With continued efforts in research, policy interventions, and sustainable practices, the industry is well-positioned to meet the growing domestic and global demand for rice while supporting the livelihoods of millions of farmers.

India's Rice Outlook for 2024

As one of the world's largest producers and consumers of rice, India's policies and production levels have significant implications for global rice markets. Based on current assessments, India is expected to prioritize meeting domestic demand and rebuilding stockpiles in 2024, with limited focus on boosting exports.

Domestic Market Priorities

The Indian government's primary concern will likely be ensuring adequate rice supplies for its vast population. With food inflation a persistent issue, maintaining affordable prices and availability in the domestic market will take precedence. Replenishing buffer stocks, which have been depleted due to various factors, including the COVID-19 pandemic's impact on supply chains and distribution, will also be a key objective.

Weather and Production Risks

India's rice production is heavily dependent on the annual monsoon rainfall, which plays a crucial role in determining crop yields. Any significant deviations from normal monsoon patterns could adversely affect production levels, further heightening the importance of maintaining sufficient stockpiles. Climate change-induced weather anomalies and the increasing frequency of extreme weather events also pose risks to rice cultivation.

Foreign Exchange Concerns

While India has traditionally been a major exporter of rice, contributing significantly to global supply, the current macroeconomic conditions may dampen export prospects. Forex reserves have been under pressure due to various factors, including rising import costs and capital outflows. However, despite the potential allure of boosting foreign exchange earnings through rice exports, domestic considerations are expected to take precedence.

Political and Policy Factors

The Indian government's policies are shaped by a complex interplay of political dynamics, electoral considerations, and the need to balance the interests of various stakeholders, including farmers, consumers, and industry players. Ahead of the next general elections, the ruling party may be inclined to prioritize domestic food security and affordable prices, rather than pursuing an aggressive export strategy that could potentially disrupt domestic supplies and drive up prices.

India's rice outlook for 2024 is primarily focused on meeting domestic demand, replenishing stockpiles, and managing potential risks from weather patterns and food inflation. While foreign exchange earnings from exports could be attractive, the government is likely to prioritize domestic market stability, at least until the next monsoon season in late 2024. Barring any significant shifts in production levels or policy changes, India's role in the global rice trade is expected to remain relatively muted, with the primary emphasis on catering to the needs of its vast domestic market.

It is important to note that this forecast is based on current assessments and could be subject to change depending on various factors, including geopolitical developments, trade negotiations, and unforeseen events that could influence India's agricultural policies and export strategies.

India Grade & Month-Wise Exports

Indian Government Paddy Procurement